When is legal GST cancellation in India applicable?

Non-filing of GST Returns: If a person registered under the regular scheme hasn't filed GST returns for six months in a row.

Filing of Composite GST Returns: If a person who is registered under the composite scheme has not filed GST returns for three months in a row.

No business activity: if someone chose to register for GST under a business name but hasn't started doing business in the six months since the registration date.

Unlawful GST Registration: If someone signed up for GST by lying about it, his GST Certificate will be canceled immediately, going back in time.

Non-payment of GST: If the taxpayer is found to have avoided paying GST taxes, his GST certificate will be revoked as a legal action.

Flout of norms: If a person who is registered for GST has broken any rules or laws, he will be subject to GST cancellation under the CGST Act of 2017.

When do we pick to cancel the GST?

There are times when a taxpayer might have to choose to give up their GST registration. Here are some examples of when a tax payer may choose to go through the GST cancellation process:

A mistaken GST registration can lead to a GST liability that isn't necessary.

If a person has signed up for GST but has a turnover of less than Rs. 20 lakhs, he can choose to cancel his GST registration.

To avoid getting tax notices from the government when a business is dissolved or merged, the GST cancellation procedure must be followed.

If the government raises the limit for GST registration and you no longer qualify, you can choose to cancel your registration.

In the case of a takeover bid, the GST registration must be given up. If it isn't, the GST tax liability will still be under the name of the previous owner.

GST CANCELLATION STATUS AFTER 28TH GST MEET

At the 28th GST meeting, the government changed how to cancel the GST. Now, the GST certificate will be put on hold as soon as the request to give up GST registration is made. So, once you've asked to cancel your GST registration, you won't have to pay any GST.

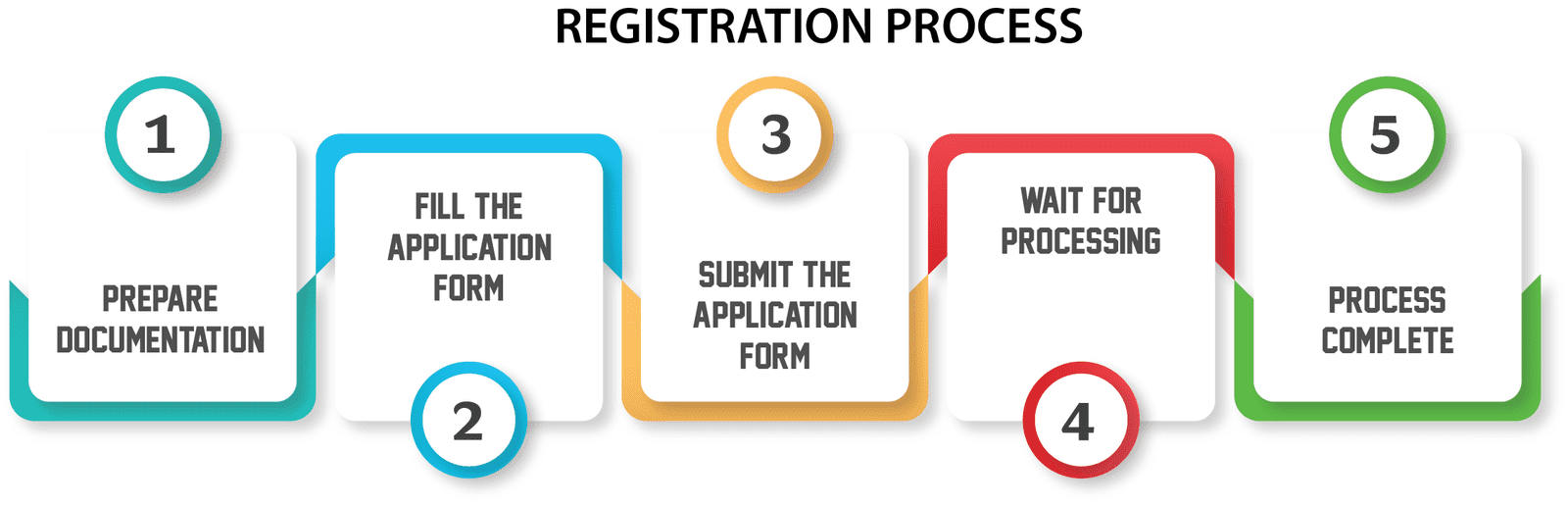

How to do GST Cancellation?

1. Provide GST information and the reasons for canceling online.

2. Consult with our business advisor about how to cancel your GST registration.

3. When you place an order, one of our dedicated professionals is assigned to your application.

4. Our professional will file FORM GST REG-16 with the GST department.

5. When you send in your application, our team will send you an acknowledgment.

6. After checking the information, the GST cancellation will be marked as "canceled."

DOCUMENTS REQUIRED FOR GST CANCELATION

1.GST Certificate

2. Reason of Cancelation