What exactly is a Section 8 company in India?

A Section 8 company is a business that is connected to a non-profit group. The goal of a Section 8 company is not to make money like other businesses. But instead, this business is meant to support charitable causes in science, culture, education, religion, etc.

The profits of an NGO company (also called a "Section 8 Company") go toward these goals and are not split among the members as dividends. Under the Companies Act 2013, Section 8, Company Registration is done as a business.

So, to put it simply, it's a company under Section 8 of the Companies Act. And because it is a company registered under Section 8, it has many benefits that you won't know about until you start the incorporation process.

What exactly is Section 8 Company Registration?

Section 8 of the Companies Act, 2018 describes how to register a company. The Non government Organization You can create a section 8 company if you register it.

Here are some common examples of section 8 companies:

Some of the names on the section 8 company list that make it worth getting the certificate of registration are: Federation of Indian Chambers of Commerce and Industry, Confederation of Indian Industries, and (hopefully) Give India.

Companies that are registered under Section 8 of the Companies Act of 2013 usually help India move forward. For now, you can think of these as examples of section 8 company names.

Most of the time, people call it the Section 8 Company Act, 2013. Is this the right way to describe this business?

No, there is no such thing as Section 8 of the Companies Act. The act that creates a business entity is the same for all business entities in India.

What are section 8 companies?

These are non-governmental organizations (NGOs) that are trying to help as many people as possible by acting like businesses.

However, these are the top ten section 8 companies in India that have been operational for a long time. As a result, if you want to compete with them, you must begin now.

Following Section 8 company incorporation, its structure would be similar to that of an NGO, trust, or society. Unlike the society registration, however, the NGO registration, which is a Section 8 company establishment, is governed by the Companies Act.

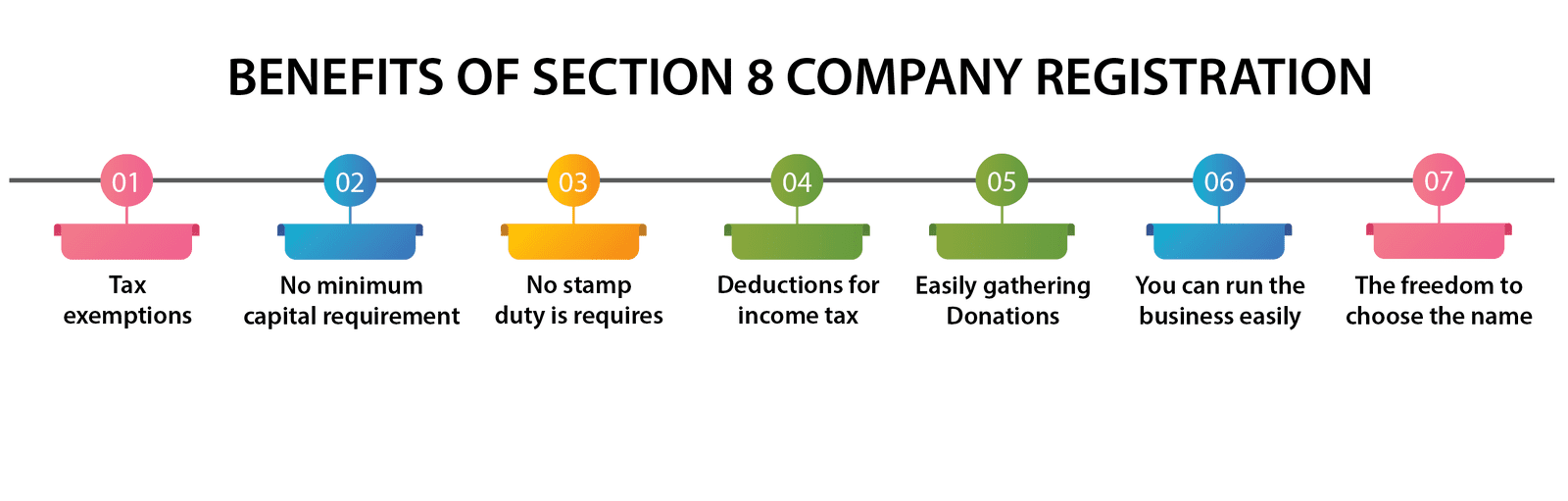

Benefits of section 8 company registration.

Tax exemptions - Section 8 of the Company Act defines a business entity as a person or group whose goal is not to make money but to make the public happy. So, the Indian government thought it was a good idea to give it several tax breaks in India. It is one of the best reasons to register under Section 8 in India.

No minimum capital requirement - For a Sec 8 company to be formed under Section 8, it doesn't need any capital. And the reason for that is simple. The government of India is trying to get more people to sign up for it by lowering the fees for registering a Section 8 company. This is because the company is trying to help people. And the way they do it is by getting rid of any minimum capital requirement.

No stamp duty is required - Since there is no minimum net worth requirement, a stamp paper is not needed to form a Section 8 Company in India. It makes sure that the stamp duty requirements don't stop the directors from registering a company.

Deductions for income tax - India has come up with special income tax deductions for section 8 companies. But you need to get the 80G and 12A registration for section As a result, the MCA is in charge of the formation of this sort of organization.

Why should you register as a Section 8 company?

Creating a Section 8 company has many advantages, which are listed below. You can also think of them as part of Section 8 Company:

1. Company law makes many exceptions. This is one of the benefits under Section 8 for businesses.

2. There is no minimum amount of paid-up capital. You can set up a Section 8 company even if you don't have any money.

3.The goal of a section 8 company must be to promote social welfare activities. Also, keep in mind that there are no orders from the state. So, the rules for NGO registration in Delhi are the same as everywhere else in India.

4. There is no stamp duty required.

5. A company can get certain tax breaks under Section 8 of the Income Tax Act.

6. A section 8 company has clear objectives that make it easy for them to ask for donations.

7. It has several privileges that make it easy to handle.

8. As this is a company, a section 8 company must have at least 2 directors and 2 shareholders. It is an important part of the infrastructure that you must meet to get NGO registration under Section 8.

But what do these advantages actually mean? The good news is that our approach to Sec 8 company registration starts with letting you know about these benefits.

Companies that are registered under Section 8 are not the same as the rest. Even though they are businesses, their main goal is to improve social welfare.8 companies in India in order to get them.

Easily gathering Donations - Donations are the best way for a Section 8 company to make money, which means that the money it gets from donations is its only source of "income."

However, that money can't be used to pay the members of the business entity. Instead, it must be used to help the company achieve its goals.

You can run the business easily.

The Memorandum of Association lists the rules that a section 8 company must follow. So, management won't be a problem for your company as long as you stick to the goals you set in your MOA.

The freedom to choose the name

In India, the name of a section 8 company doesn't have to include the words "company" or "limited." This business entity includes a word that emphasizes that the company is an organization, such as Foundation, Electoral Trust, Chambers, Federation, etc.

These benefits of section 8 companies are only available to people who meet the requirements.

Section 8: Company Registration Eligibility Criteria

So, who can make a Section 8 company? Anyone is the right answer. But there are some legal requirements that you must meet first.

So, before you can start the incorporation of a Section 8 company, you have to meet the following requirements:

1. The main objective of a Section 8 company should be to help business, science, education, sports, religion, charity, social welfare, and other good causes. So, before you set up a Section 8 company, you should be clear on the causes you want to support.

2. The Section 8 Company should have an original name. So, it is recommended that the applicants check to see if the NGO name is already taken before moving forward.

3. The profits made by the Section 8 company will be used to support the causes listed.

4. The directors of a section 8 company are not allowed to split the company's profits as dividends.

5. After incorporating, you have to agree to follow section 8 company compliance because that's the only way to keep your business entity in its current state.

As soon as you meet the eligibility requirements listed, you can start collecting the documents for online Section 8 Company Registration.

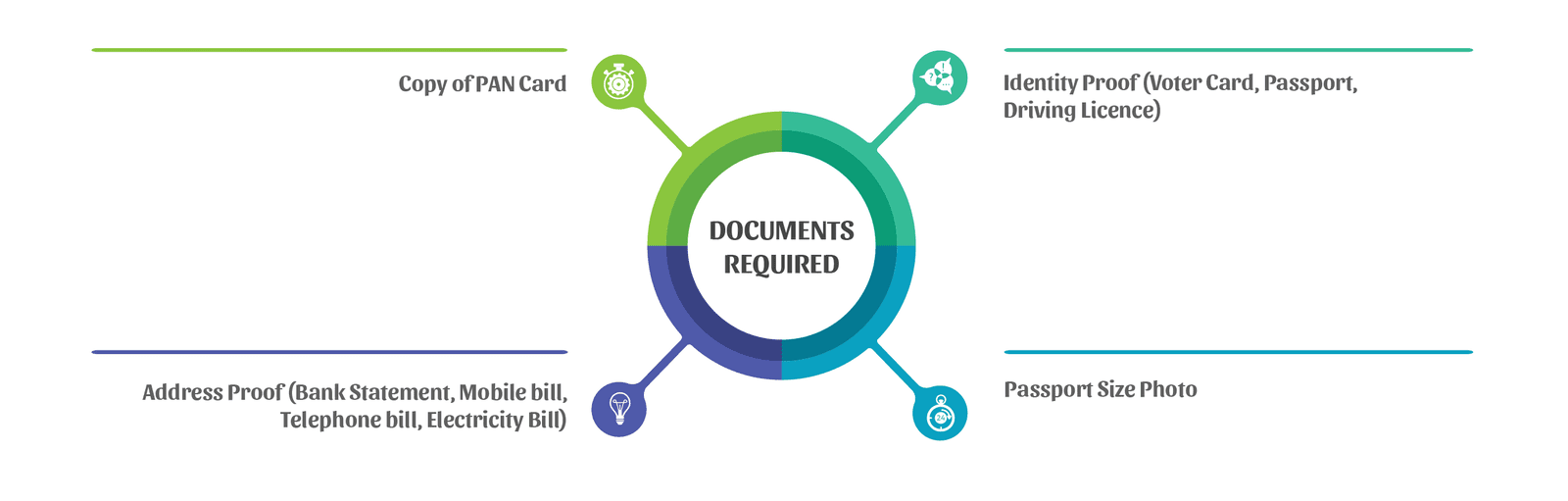

The Documents Needed to Register a Section 8 Company in India

Here are the documents that each director or shareholder needs for section 8 company registration online.

The section 8 Company Registration Documents for Directors and Shareholders are the following:

Copy of PAN Card

Identity Proof (Voter Card, Passport, Driving License)

Address Proof (Bank Statement, Mobile bill, Telephone bill, Electricity Bill)

Passport Size Photo

For the Registered Office, these are the Section 8 Company Documents:

Ownership Proof (Electricity Bill, Gas bill Bill, Mobile Bill)

NOC (Download Format)

Make sure that these section 8 company incorporation documents are uploaded in the right format during the application process. How do you register a Section 8 company?

How do you register as a Section 8 company?

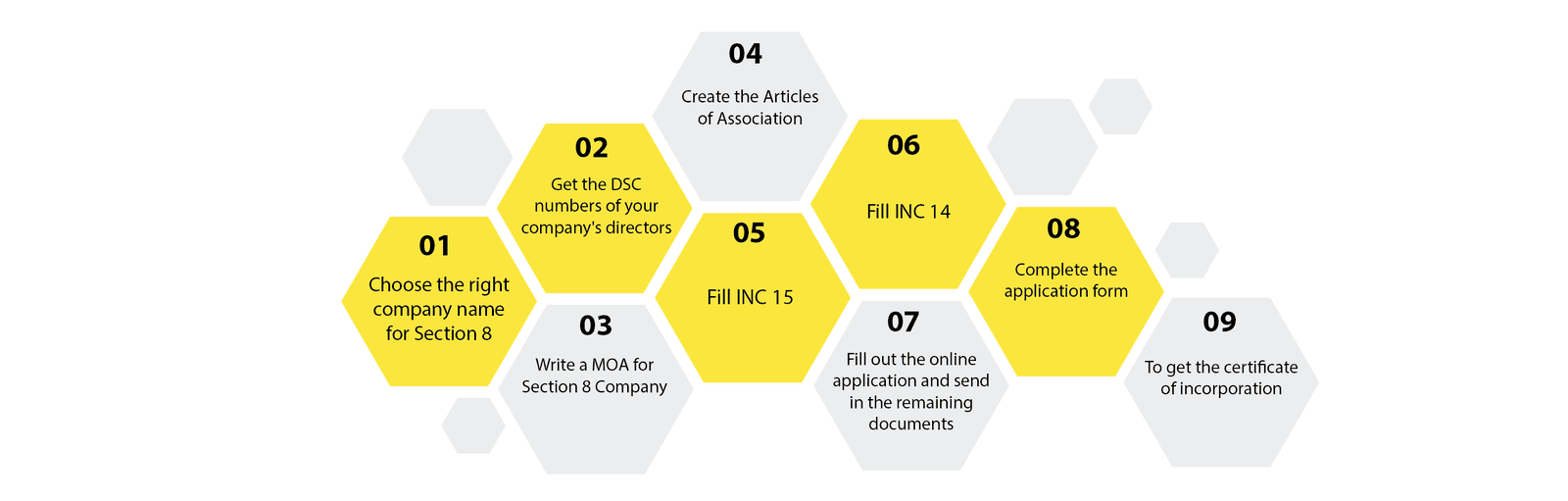

Choose the right company name for Section 8: The first step in registering a company under Section 8 is to come up with a good name for it. Compared to other limited business entities, the Section 8 company name rules are less strict.

For example, your name doesn't have to include the words "Section," "8," or "Company." But if you need help, you can look at our ideas for section 8 company names.

Furthermore, the best way to make sure that a name is unique is to check the Section 8 company name availability. In this way, our section 8 company name search can also help.

Make sure that you follow section 8 of the Companies Act. But make sure that the Section 8 Company Suffix includes the words "federations," "authorities, and others.

Get the DSC numbers of your company's directors: The second step in the answer to your question about how to register a section 8 company in India is to get a Digital Signature Certificate. This is a process that helps verify the documents you upload online. This is an important step in setting up a section 8 company.

Write a MOA for Section 8 Company: MOA means Memorandum of Association. It is filed under INC 13 and Section 8 Company. It contains information about the directors, the shareholders, and the goals of the section 8 company. For example, if your goal is to educate, the moa of section 8 company for education should say that your goal is to promote education.

Create the Articles of Association: The Section 8 NGO should follow certain laws and rules. The Articles of Association are the documents that explain these things.

Fill INC 15: File a joint declaration with Form INC 15 for Section 8 Company. Here, you will say that all of the points in the Section 8 company MOA are in line with the MCA's Section 8 regulations.

Fill INC 14: All of the directors of your Section 8 NGO must also file an individual declaration using FORM INC 14 for Section 8 Company. They each have to say that the Memorandum of Association makes it clear what their jobs are.

Fill out the online application and send in the remaining documents: The final step is to get a certificate of incorporation. And to do that, you must submit the application for section 8 NGO registration online. The Ministry of Corporate Affairs runs the portal for Section 8 India Registration.

Complete the application form: Start filling out the online application for Section 8 company registration. Make sure that all the information you give matches what the rules for Section 8 Non-Profit Company say.

Also, make sure you've carefully looked over Section 8 AOA and AOA before entering their details on the application form.

When it comes to documents, the MCA Section 8 company rules are pretty strict. So pay close attention ahead of time.

To get the certificate of incorporation: If the Registrar of Companies accepts your Section 8 company registration form, your company will get a license under Section 8 of the company registration act.

As an NGO that falls under Section 8 of the Companies Act, you will be able to get a lot of benefits from now on.

The MCA has set up special times for setting up a section 8 company under the Companies Act of 2013. So, you can get the registration certificate on time.

As for the Section 8 company registration fees, it would depend on your stamp duty.

Even though you can register a limited company online, that doesn't mean it's easy to get.

In the right hands, this Section 8 company procedure shouldn't take more than a week to finish. But the words that matter here are "right hands."

Under the Companies Act of 2013, it's not easy for everyone to register as a section 8 company in India. Our NGO registration consultant can help you with that. We help you with everything you need to register a section 8 company online in India.

Our Help with Section 8 Company Registration in India

We at Certpedia offer end-to-end solutions for Section 8 company registration in Delhi and the rest of India. It's because we know everything there is to know about section 8 company registration in India, down to the smallest details. That knowledge helps us give you the following services:

Meeting the initial Section 8 company requirements

Company name research

Obtaining DSC and DIN

MOA and AOA drafting

Application filing

The Ministry of Corporate Affairs was contacted again.

You should choose Section 8 company registration if you want to help people and work for the betterment of society. Its formation is not an easy process. But Certpedia can make it easier. Our company registration experts make it easy for you to incorporate a Section 8 company at a low cost. Contact our experts, and we'll start with section 8 incorporation.