TDS Returns of Different Kinds

Form 24Q

This form needs to be filled out for an employee's salary tax deduction. All employers in India have to fill out this form.

Form 26Q

This form is for tax deductions on things other than salary, like rent, professional fees, interest, dividends, payments to contractors, etc.

A Form 26QB

The purpose of this form is to file TDS returns about a deduction on income from the sale of real property in India.

Form 27Q

The goal of this type of return is to give information about the transactions related to the foreign payments made.

Form 27EQ

The TCS Return is filled out for transactions like the sale of liquor, Tendu leaves, scrap metal, timber, etc. Taxes are taken out right where they are made.

Form 27D

This type of form is used to get the certificate of tax collected at source, or the TCS. This certificate from TCS verifies the return on Form 27EQ.

Why is it important to file your TDS returns on time?

To avoid the fine: Filing the TDS/TCS return late would definitely result in a heavy fine of INR 200 per day for as long as the default continues.

To avoid an extra penalty, in addition to the minimum fine of INR 200, the tax Deductor would have to pay an extra fine if the TDS return wasn't filed within a year of a certain date. This costs anywhere between INR 10,000 and INR 1 lakh.

To make it easier to reconcile the ITR, the main reason for filing a TDS return is to match up the income that was actually earned with the income that was reported on the income tax return.

To keep from having to cancel the expense, if the person who was supposed to file the TDS return doesn't do it on time, the assessing officer may choose to cancel the effect of the expense on which TDS was supposed to be deducted but wasn't. So, they are responsible for paying more taxes.

Helping people fill out Form 26AS: Form 26AS is an annual consolidated tax statement that shows the details of the taxes taken out during the year. Anyone can ask for a TDS credit if there are entries on Form 26AS. If you take someone's TDS but don't file a TDS return, that person may rush to you at the last minute for the same amount.

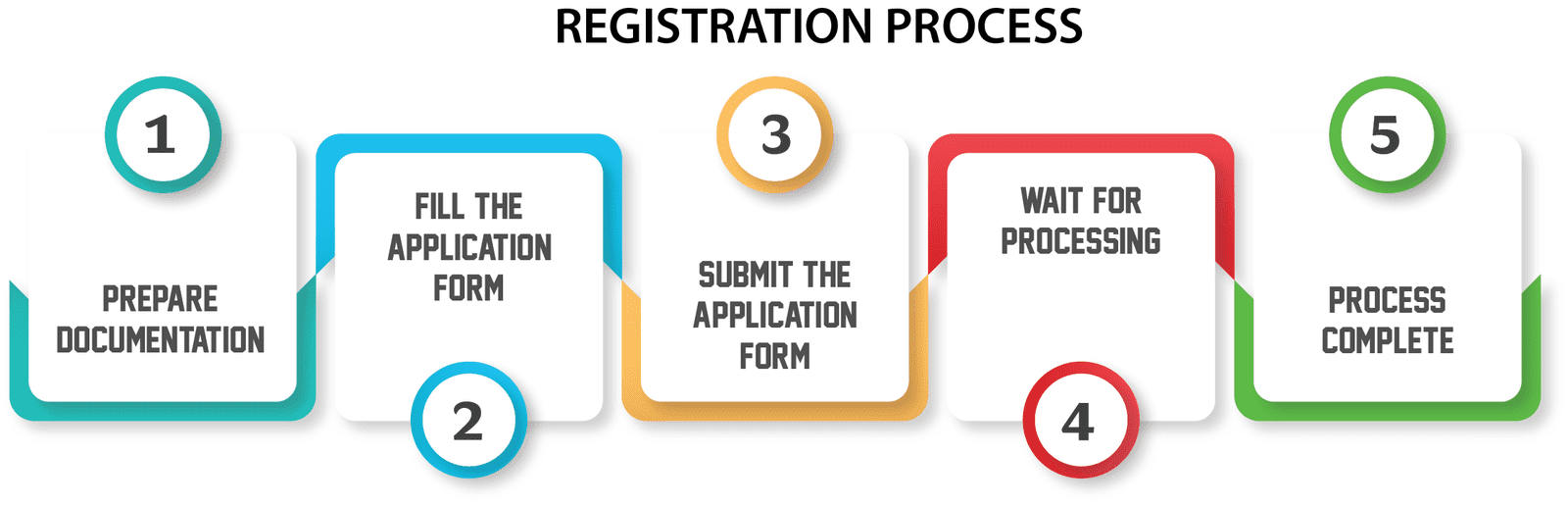

The TDS return filing process

1. Upload the necessary information and documents for filing TDS returns on our web portal.

2. Choose the right package and pay online. Different ways exist to pay online.

3. When you place your order, your application will be received by one of our dedicated professionals.

4. Our professional team will make your TDS return and give you a statement to sign off on.

5. Once it has been approved, our professionals will file an online TDS return.

6. An acknowledgment You will get an email with your TDS return receipt.

TDS RETURN DOCUMENTS REQUIRED

1. Details of Deduction

2. TAN