Want to create a charitable trust?

In India, if you want to start a charity, you have to register it under the Societies Act. Get in touch with I Standard Solutions, and we'll make sure that the process of registering goes smoothly and quickly.

What exactly is a trust?

A trust is an agreement in which property is given to or "vested" in a person so that they can use and dispose of it for the benefit of another person. But that's just how trust is defined by the law in India. Let's not try to figure out what "trust" means to an Indian.

What is the registration of trust?

A Welfare Trust Registration, or just a Trust Registration, is a legal entity that exists and is governed by the Indian Trust Act of 1882 (mistakenly called the Trust Registration Act of 1882). A legal agreement between two parties is called a "registered trust." One person or group is the recipient, and the other is the giver. According to the contract of a registered trust in India, the donor has the power to give the beneficiary his assets.

In the legal world of trust deed registration, the person who gives the money is called the trustor, and the person who gets the money is called the trustee. But why would someone choose to set up a trust? Is it only to get the benefits of the Income Tax Act's trust registration? Both "yes" and "no" are right.

Advantages of Creating a Trust in India

Setting up charity organizations

Starting a charitable trust in Delhi by registering a charitable trust in India will require a number of charitable activities. You can explain why you are registering a trust in India in the bylaws, and you will be able to help a lot of people.

Help for Kids

If you want your kids to have a safe future, you can work toward private trust registration in India. Unlike a public charitable trust registration, it will let you become a trustee and carefully manage your assets so your beneficiaries, your children, can have a secure financial future.

Tax Exemptions

Getting an online trust registration, whether it's a public trust registration or a private new trust registration, can get you out of paying some taxes. Most of the time, a trust is seen as similar to an NGO. So, public trusts in India can get tax breaks if they register as charitable trusts under the Income Tax Act with registration under Section 12A and Section 12AA. Setting up a trust online and getting it registered under Section 12AB is also good for tax purposes because of special rules.

Helping People Who Are Mad

A trust registered under Section 12A not only helps with online registration, but it also helps bring together people who all want to help the most people.

Simple Addition

There are no problems with registering a trust in Delhi. The steps are easy to follow and easy to put into action. One only needs to fill out the trust registration form using the right format, go to the trust registration office in Delhi, and get the registration certificate on time.

Coverage for Family Wealth

In India, people who want to protect their assets should register a private trust as soon as possible.

Putting up Temple

Registration of a religious trust is something you can do if you are religious. You can use the Temple Trust Registration process to set up a group that will help build a temple in the future.

India Trust Registration Types

Trust registrations are made up of two different types:

creating public trust

Public Trust is also known as a non-profit charitable organization or a non-governmental organization. A public trust has the following goals:

1. To set up a school or educational institute to teach the children

2. To open a hospital or nursing home so that poor people can get medical care.

3. To take care of the elderly, widows, children, and people with disabilities.

4. To improve the health of children and women and give women more power.

5. To help people in need in society.

6. To offer religious and other cultural activities

7. To give people from backward or poor classes the training they need.

8. To build temples and do other things related to religion,

9. To form groups to protect the environment.

10. To give the poor food, a place to live, clean water, and other basic needs.

11. In the end, the goal of public trust registration in India is to help people in need.

Making a private trust

In this trust, the people or families who get the money are the beneficiaries. The following are the goals of this type of trust:

1. To help and care for a certain family member

2. To take care of and maintain a property

Public-cum-Private Trust

A public-private trust is an organization with two goals. The money they bring in can be spent on public or private things. In India, this type of trust is thought to be the most flexible.

Trust Deed

The trust deed registration is part of the trust registration. In a trust deed, the goals, objects, and ways of running the trust are written.

If you want to register a trust in Delhi or register a trust deed in Delhi, you should contact I Standard Solutions. We can help you with everything that has to do with registering this entity. Our experts will make sure that your trust is registered when it should be.

However, it's not enough just to set up the trust. Once you have the trust deed registration certificate, you must follow the rules. If you don't, you'll have to pay a lot of fines that you can't avoid:

India has penalties for running a trust that hasn't been registered.

Legal and illegal punishments

The Trust Registration Act says that it is against the law not to follow the rules set out in the trust deed. You will then be subject to both civil and criminal penalties.

inability to get a Tax Deduction Account Number

The Tax Deduction Account Number must be obtained by a trust. Section 27BB of the Indian Trust Act of 1882 says that not doing so is a crime.

failure to send in tax returns

Not every trust is considered a nonprofit organization. Tax benefits cannot be used by the trust unless it is registered under Section 12A of the Income Tax Act. It means that the trust has to give the tax returns on time. If you don't follow the rules, your company will have problems.

Conditions for registering a trust in India

To get a trust's registration certificate, you must keep the following in mind:

1. The rules in the bylaws should be followed by your trust.

2. All of the people listed in your trust should have good records.

3. The purpose of your trust shouldn't go against the Indian Trust Act of 1882.

4. The person who wants to register a trust must follow the exact rules for doing so.

5. You must agree to follow the rules and regulations in your bylaws always.

6. You must list the people who will get the money in the documents you send to India for trust registration. For example, when you apply to register a family trust in India, you must give clear information about the trust or and the trustee.

What Documents Are Needed to Register a Trust in India?

The following are the requirements for registering a private trust in India:

1. Information about the trustee

A. Name;

B. Job Title

C. Address;

D. Date of Birth;

E. Title

F. How to get in touch

G. Picture-taking

2. Proof of the Trustee's address

A. ID to vote

B. A license to drive;

C. A passport

3. Proof of who owns the office

A. Electricity bill

B. Tax bill for the house

C. Permission from the landlord if the property is rented

4. Witnesses and Settlers

A. When you register, you need to bring two witnesses with you.

B. The person moving in should also be there when they register.

When registering a charitable trust, the details will stay the same. But there will be a difference in the details that are given about the trustee.

Note: The documents for registering a trust will be the same in every state. For example, the documents needed to set up a trust in Delhi will be the same as those needed everywhere else.

In India, how do you register a trust?

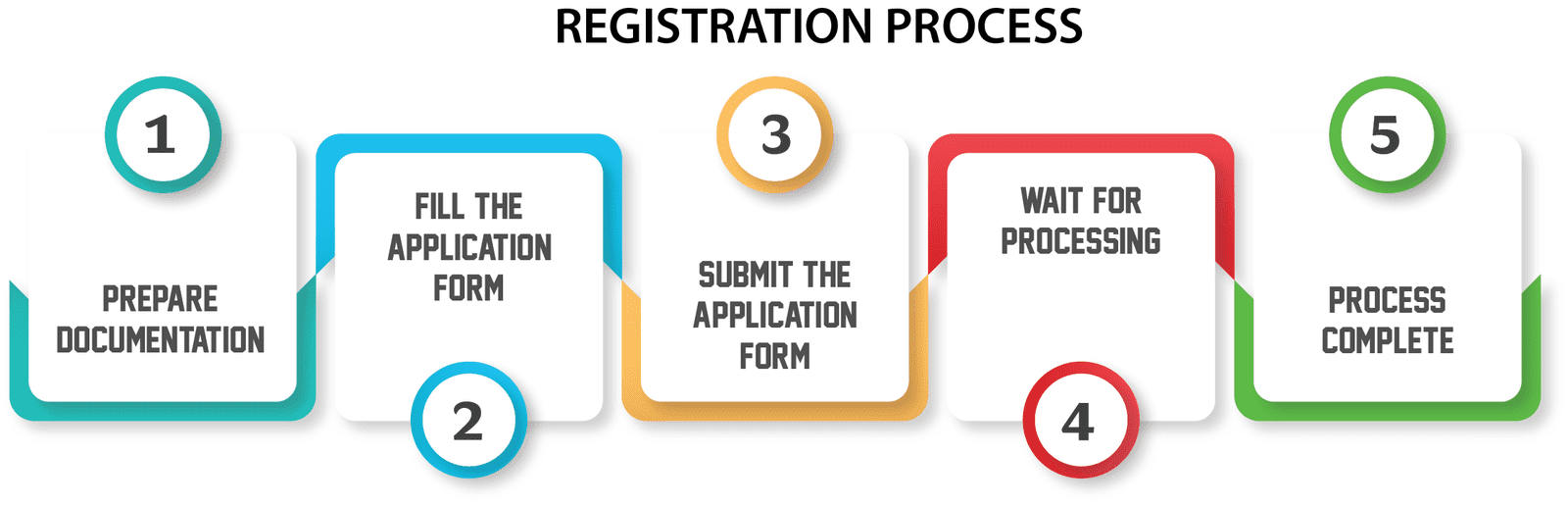

Here is how to register a trust online in India, step by step:

Pick a different name for the trust.

Your first job is to give your trust a proper name. You can only register a trust online if the name you choose is trustworthy and meets the requirements of the government of India.

1. For a trust to be made, your name can't go against the Emblems Act.

2. The name shouldn't be against the law.

3. The name you pick should be the only one.

Putting together the Trust Deed

Create your trust's rules and put them in the trust deed.

Documentation

Get together the documents you need to register a trust. Make sure that all the papers are signed right away.

Filling out an application online

To set up a trust online, the applicant must fill out a form. Go to your state's trust registration website and start filling out the application there.

Putting in an application

Send the online application for trust registration along with the necessary documents to the right authority.

Obtain the Trust Registration Certificate

The society registrar looks at more than just the documents and the registration. It's also what your trust is for. If the registrar thinks you deserve it after the analysis, you will get the trust registration certificate.

What can we do to help?

I Standard Solutions is a group of leading business professionals who know a lot about trust registration. In addition to answering your questions about what a trust registration certificate is and what its rules and regulations are, we will also provide you with the following services:

1. Document submission

2. Applying

3. Departmental follow-up

4. Help get rid of the mistakes in the application form.

We are India's leading trust registration consultant, and our office is in Delhi. We can help you with trust registration quickly and completely.