What is Nidhi Company Registration in India?

The Nidhi Company is an Indian business entity governed by the Companies Act 2013. Its sole purpose is to encourage thrift and savings among its members. A Nidhi Company is a non-banking financial institution that only offers lending and deposits to its members. As a result, it is possible to say that a Nidhi company in India is only funded by its members and shareholders.

In India, establishing a Nidhi company entails establishing a Non-Banking Financial Companies class. The Reserve Bank of India is in charge of them. This body provides lending and depositing guidelines to registered Nidhi companies. On the other hand, Nidhi companies can only deal with their members. As a result, outside members are not permitted.

Why should you establish a Nidhi Company?

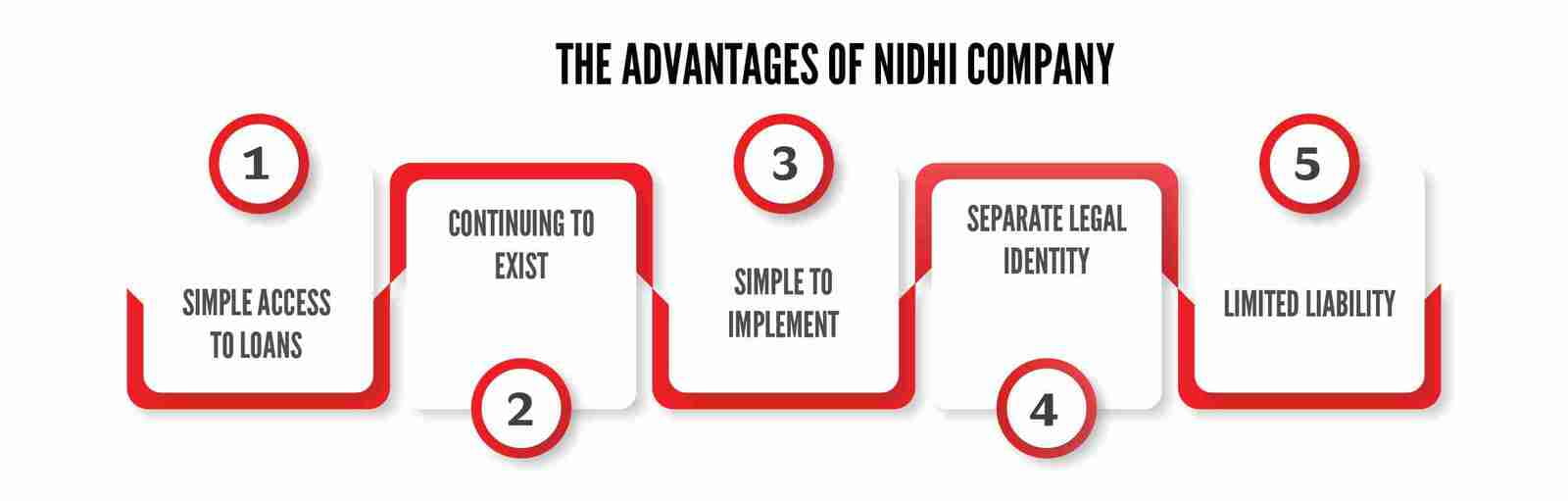

The Advantages of Nidhi Company

Nidhi Company is one of the business entities that benefits from the company's benefits. The following are the benefits of Nidhi Company Registration:

Simple access to loans: As a Nidhi company is an infrastructure that is recognized by the central government, banks are more likely to trust it. So, once you register a Nidhi company, it is easy to get loans and other types of funds.

Continuing to Exist: Even if one of the directors dies, a Nidhi Company continues to exist.

Simple to implement: A Nidhi Company can be formed quickly. It adheres to the standard procedure for Company Registration in India.

Separate legal identity: It gains its own legal identity in India after establishing a Nidhi company. A Nidhi company can be considered a separate individual who can own property, invest, and so on.

Start up your mutual fund company

When you register a Nidhi company in India, you can enjoy benefits like limited liability, easy access to loans, and more. Get started by getting in touch with Certpedia.

What is Nidhi Company Registration in India?

The Nidhi Company is an Indian business entity governed by the Companies Act 2013. Its sole purpose is to encourage thrift and savings among its members. A Nidhi Company is a non-banking financial institution that only offers lending and deposits to its members. As a result, it is possible to say that a Nidhi company in India is only funded by its members and shareholders.

In India, establishing a Nidhi company entails establishing a Non-Banking Financial Companies class. The Reserve Bank of India is in charge of them. This body provides lending and depositing guidelines to registered Nidhi companies. On the other hand, Nidhi companies can only deal with their members. As a result, outside members are not permitted.

Why should you establish a Nidhi Company?

The Advantages of Nidhi Company

Nidhi Company is one of the business entities that benefits from the company's benefits. The following are the benefits of Nidhi Company Registration:

Simple access to loans: As a Nidhi company is an infrastructure that is recognized by the central government, banks are more likely to trust it. So, once you register a Nidhi company, it is easy to get loans and other types of funds.

Continuing to Exist: Even if one of the directors dies, a Nidhi Company continues to exist.

Simple to implement: A Nidhi Company can be formed quickly. It adheres to the standard procedure for Company Registration in India.

Separate legal identity: It gains its own legal identity in India after establishing a Nidhi company. A Nidhi company can be considered a separate individual who can own property, invest, and so on.

Limited Liability: Members of a Nidhi company have limited responsibility for its debts. This means that if the Nidhi Company goes bankrupt, the members' assets won't be hurt.

The Criteria for Nidhi Company Registration in India.

1. In a Nidhi company, there must be at least three directors.

2. The Nidhi Company should have at least one Indian director.

3. There can be at least seven shareholders in a Nidhi company.

4. Nidhi Company capital requirements: A Nidhi company must have at least INR 5 Lakh in equity share capital in order to be registered.

Rules of Incorporation

1. A Nidhi firm that is about to be formed must be a public company.

2. A Nidhi company that is about to be formed must have a minimum paid-up equity share capital of five lakh rupees.

3. A Nidhi company that is about to be formed must issue preference shares.

4. A to-be-included Nidhi Company's Memorandum of Association must have no other purpose than to instill the habit of thrift and saving in its members.

5. A to-be-included Nidhi Limited must be the last part of its name.

Share Capital and Allotment

1. Every Nidhi must give out equity shares with a nominal value of no less than ten rupees each.

2. No service charge can be made when shares are given out.

3. Every Nidhi must give each deposit holder a minimum of ten equity shares, or shares worth a hundred rupees each. A person with a savings account or a recurring deposit account must own at least one equity share worth ten rupees.

Membership

1. A Nidhi can't let a corporation or trust join.

2. A Nidhi must make sure that its number of members doesn't drop to less than 200.

3. A Nidhi can't let a minor join, but they can accept deposits in the name of a minor if their legal guardian is also a member.

Net-owned Funds

Every Nidhi must keep net owned funds (not including the proceeds of any preference share capital) of at least ten lakh rupees or a higher amount that the Central Government may set from time to time.

Rate of interest

The interest rate that a Nidhi company can charge on a loan can't be more than 7.5 percent higher than the highest rate of interest that Nidhi offers on deposits. The reducing balance method must be used to figure out the interest rate.

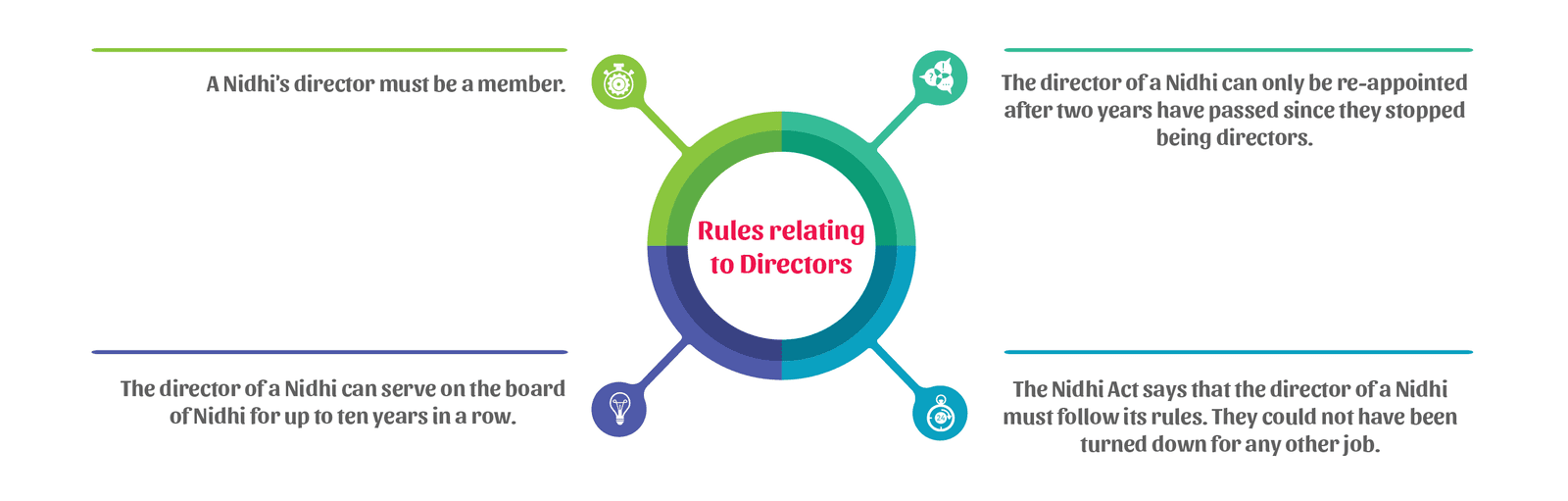

Rules relating to Directors

1. A Nidhi's director must be a member.

2. The director of a Nidhi can serve on the board of Nidhi for up to ten years in a row.

3. The director of a Nidhi can only be re-appointed after two years have passed since they stopped being directors.

4. The Nidhi Act says that the director of a Nidhi must follow its rules. They could not have been turned down for any other job.

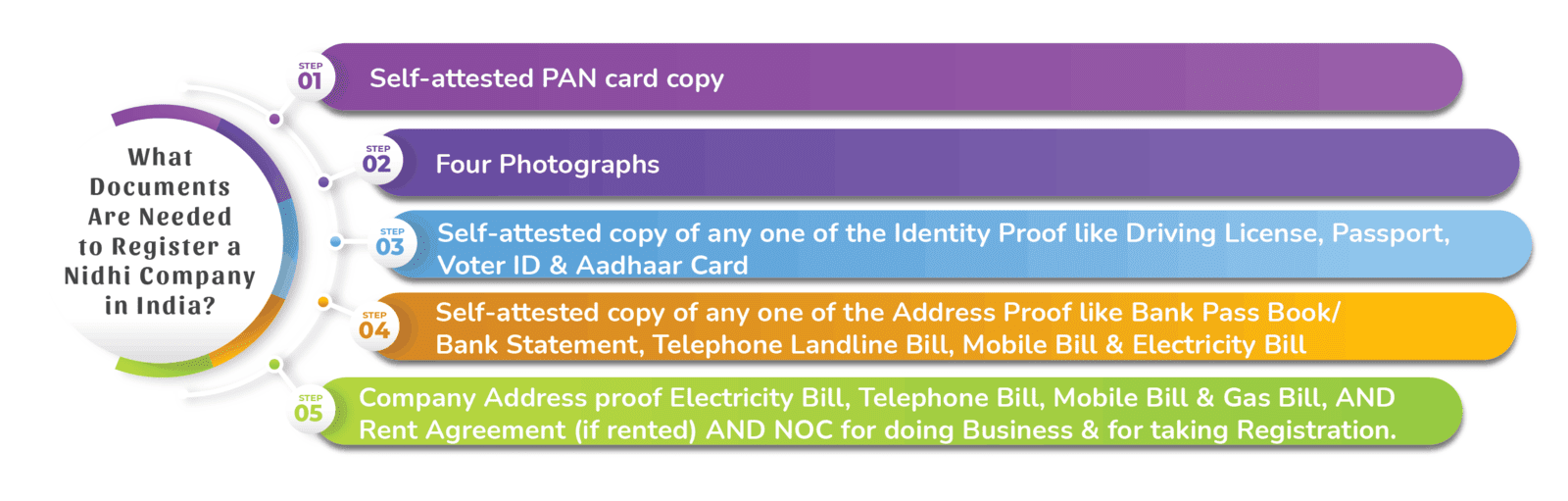

What Documents Are Needed to Register a Nidhi Company in India?

These are the documents that each director or shareholder needs to start a business.

Self-attested PAN card copy.

Four Photographs.

Self-attested copy of any one of the Identity Proof like Driving License, Passport, Voter ID & Aadhaar Card

Self-attested copy of any one of the Address Proof like Bank Pass Book/ Bank Statement, Telephone Landline Bill, Mobile Bill & Electricity Bill

Company Address proof Electricity Bill, Telephone Bill, Mobile Bill & Gas Bill, AND Rent Agreement (if rented) AND NOC for doing Business & for taking Registration.

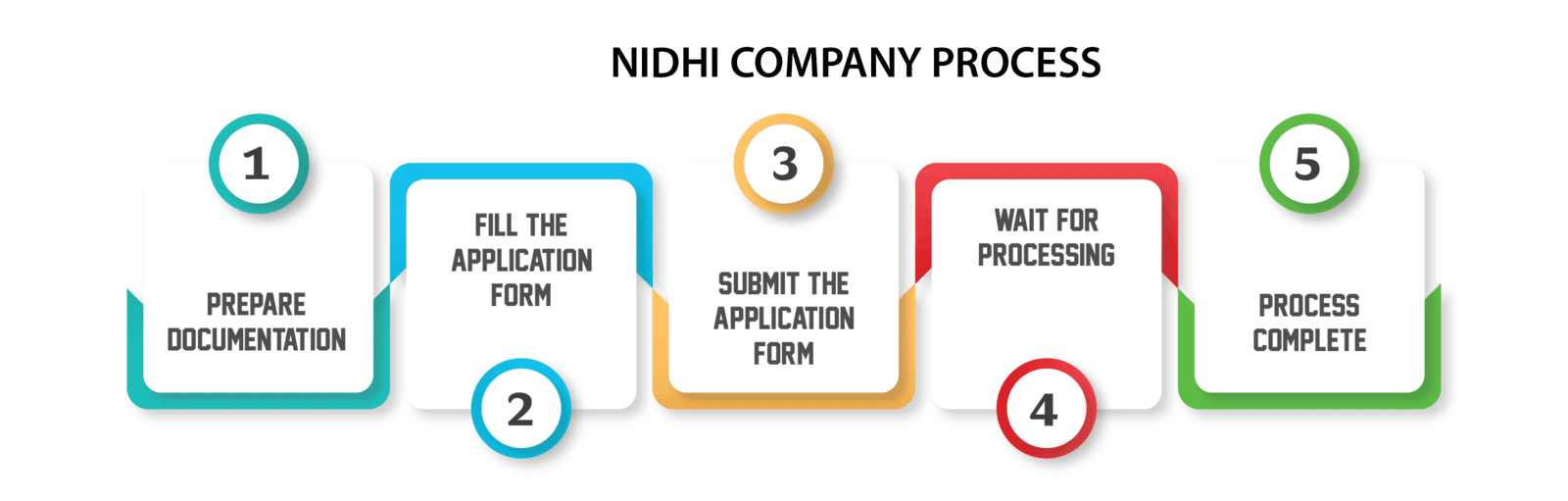

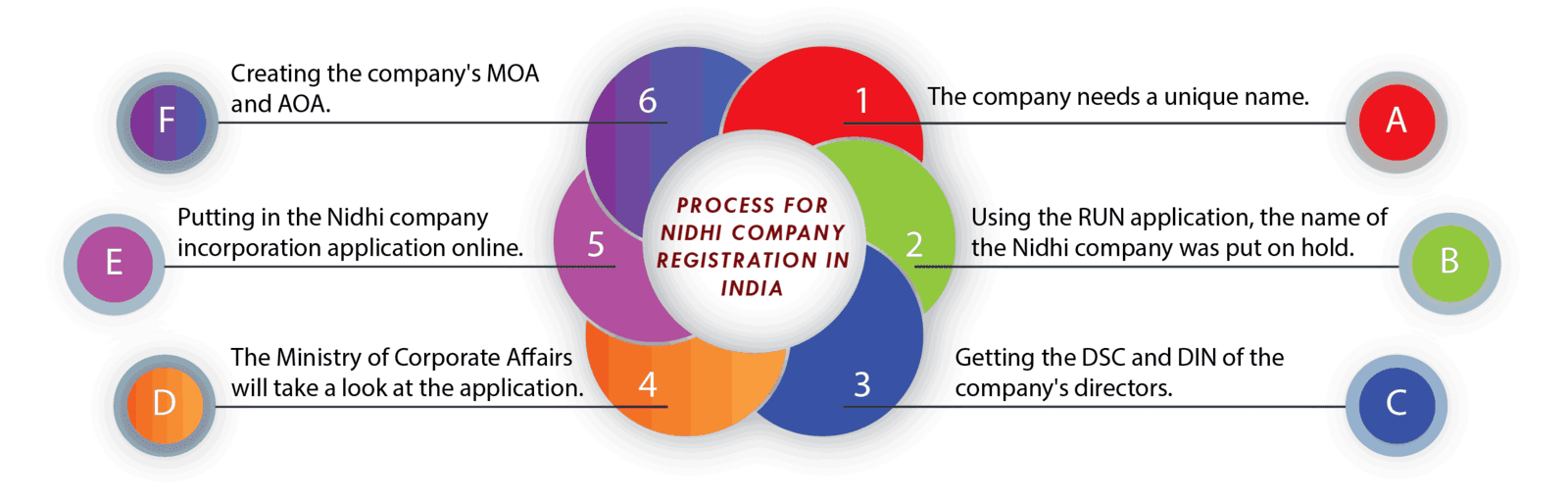

Process for Nidhi Company Registration in India

How Do You Form a Nidhi Company? The Nidhi Companies are governed by the Nidhi Rules of 2014. The following is the procedure for registering a Nidhi corporation in India online:

1. The Nidhi company needs a unique name. Search for the Nidhi company name. You can also hire Nidhi experts to come up with names for your Nidhi company.

2. Using the RUN application, the name of the Nidhi company was put on hold.

3. Getting the DSC and DIN of the company's directors.

4. Creating the company's MOA and AOA

5. Putting in the Nidhi company incorporation application online.

6.The Ministry of Corporate Affairs will take a look at the application.

Rules for establishing Nidhi Branches

1. A Nidhi can only open branches if it has made net profits after taxes for the past three years in a row.

2. Within the district, a Nidhi can open up to three branches.

3. If a Nidhi wants to open more than three branches in the district or any branches outside the district, it must first get permission from the Regional Director.

4. Every branch must let the Registrar know within thirty days that it is opening.

5. A Nidhi can't open branches, collection Centre, offices, or deposit Centre where its registered office is or if it hasn't given the Registrar its financial statements and annual returns.

Branch Closure

1. A Nidhi must not close any branches unless

2. At least 30 days before the closing, an ad is put in a newspaper to let people know.

3. Put a copy of the ad telling about the closure on the bulletin board at Nidhi for at least 30 days after the date of the ad.

4. Gives notice to the Registrar within thirty days of closing.

The Deposit Regulations of the Nidhi

1. A registered Nidhi shall accept deposits for a minimum of six months and a maximum of sixty months.

2.A Nidhi that is registered must accept recurring deposits for at least 12 months and up to 60 months.

3. At any time, the most that can be in a savings deposit account is one lakh rupees. The interest rate can't be more than 2% higher than the interest rate that nationalized banks pay on savings bank accounts.

4. A Nidhi must pay interest on fixed and recurring deposits at a rate that does not exceed the maximum interest rate set by the Reserve Bank of India.

5. A registered Nidhi must close a depositor's fixed deposit or recurring deposit account under the following conditions:

a. A Nidhi must not return any deposit within three months of being accepted.

b. After three months, a depositor can ask a Nidhi to return the money. Also, the depositor shouldn't be able to get any interest for the first six months after making the deposit.

Nidhi Regulations on Loans

A Nidhi must only lend money to its members.

The loans that a Nidhi gives to a member must not go over the following amounts:

1. If the total amount of deposits in that Nidhi from its members is less than two crore rupees, the penalty is two lakh rupees.

2. Seven million fifty thousand rupees, if the total deposits from the members of that Nidhi are more than two crore rupees but less than twenty crore rupees.

3. Twelve lakh rupees, if the members of the Nidhi have put in a total of more than twenty crore rupees but less than fifty crore rupees; and

4. Fifteen lakh rupees, if more than fifty crore rupees have been put into this Nidhi by its members.

The deposits must be figured out based on the most recent audited annual financial statements.

A Nidhi can only lend money to its members against the following assets:

a. Gold, silver, and Jewellery

b. Immovable Property

c. Fixed Deposit Receipts

d. National Savings Certificates

e. Insurance Policies

f. Other Government Securities

Restrictions & Prohibitions

Nidhi Company Compliances

Nidhi companies can't be involved in the

chit fund business,

hire purchase finance,

leasing finance,

insurance, or

acquire securities issued by anybody corporate.

A Nidhi company must not issue

preference shares,

debentures, or

any other type of debt, regardless of its name or appearance

A Nidhi company can't open a current account with any of its members.

1. purchase securities in order to acquire another firm.

2. A Nidhi company can't do any business other than borrow or lend in its own name.

3. control the composition of any other company's board of directors, or

4. Make any arrangements for a change in management.

5. A Nidhi company can't accept deposits from people who aren't members or lend money to people who aren't members.

6. A Nidhi company can't use the assets deposited by its members as security.

7. A Nidhi company can't accept deposits from or lend money to corporations.

8. A Nidhi company can't go into any partnership when it comes to borrowing or lending.

9. A Nidhi company can't put out any ads that ask for deposits.

10. A Nidhi company must not pay a broker or any other incentive.

a. collecting deposits from members.

b. Funding deployment, or Making loans.

We can help you register a Nidhi company in India.

With the help of our Nidhi company registration consultant, we at Certpedia provide end-to-end solutions for Nidhi business registration. Among our offerings are:

Company name research

Obtaining DSC and DIN

MOA and AOA drafting

Application filing

Contacting the Ministry of Corporate Affairs again