What is GST Registration?

Goods and Services Tax is a policy that combines indirect taxes like VAT, CST, Service Tax, Central Excise Duty, Entertainment Tax, etc. It went into effect on July 1, 2017, and is valid all over India.

When to apply for GST: It's required to sign up for GST if your annual revenue is more than INR 40/20 lakh, if you sell goods and services across state lines, or if you sell through an e-commerce platform.

How much does the GST tax cost: Tax rates can be anywhere from 0% to 28%, depending on the goods and services you are selling.

Input Tax Credits That Can Be Taken Advantage Of: Only a business unit that is registered under GST can get a credit for the tax paid at the time of purchase when filing GST returns.

Return Filing & Payment: Every person who is registered for GST must file three monthly or quarterly returns and one annual return. Every month, one has to pay taxes.

The composition scheme is as follows: The scheme is available to business units with annual sales of less than INR 1.5 crore. requires to pay a subsidized tax of 1% to 5% and file a quarterly return.

When is GST registration in India required: The Criteria for Turnover

The Criteria for Turnover: All taxpayers with an annual turnover of more than Rs 40 lakhs are required to register for GST again.

Causal taxpayer: If you sell goods or services at events or exhibitions but don't have a permanent place of business, you need to get an online GST registration before you start a business. A dealer like this has to pay GST based on an estimated 90-day turnover. The GST registration for casual users is valid for a period of ninety days.

NRI taxpayer: If an NRI taxpayer who doesn't have a place of business in India wants to start a business, he has to apply for GST registration in India before he can start doing business in India. The new GST registration is good for 90 days.

Agents of a supplier or distributor of input services: Input service distributors who want to carry forward the benefit of input tax credit must register for GST.

Reverse Charge: A business that needs to pay tax through the reverse charge mechanism needs to be registered for GST.

E-Commerce portal: Every e-commerce site (like Amazon or Flipkart) where multiple sellers sell their goods needs to be registered for GST.

Why should I register for GST?

GST registration not only helps you get your business recognized as a legal registrant, but it also opens up a number of opportunities for your business. At first glance, businesses that are registered for GST can enjoy the following:

Become more competitive: Since you will have a valid tax registration, you will be more competitive than your competitors who don't have one.

Grow your business on the Internet: Without GST registration, you can't sell goods or services on an e-commerce platform. If you want to sell on e-commerce platforms like Flipkart, Amazon, PAYTM, Shopify, or your own website, you must have a GSTIN.

You can get a tax credit for: Only people who are registered for GST can save money by using the GST tax they paid on purchases as an input.

can sell everywhere in India without any limits: You can't trade between states if you don't have a GSTIN. This is only possible if your business is registered for GST.

Apply Government Tenders: To apply for government tenders, you need a GSTIN. If you don't have it, you might miss out on the business opportunity.

Open Current Bank Account: Especially if you're a sole proprietor, banks and other financial institutions won't let you open a current bank account in the name of your business's trade name unless you have official documentation in the name of your business. The GST registration certificate can help you open a current bank account.

Dealing with MNCs: MNCs usually don't feel comfortable working with small businesses until they can show proof that they are registered for taxes.

What exactly is the GSTIN?

The Goods and Service Tax Identification Number (GSTIN) stands for "Goods and Service Tax Identification Number." It is made up of 15 letters and numbers. This is what the government gives you after you have successfully registered for GST.

First 2 digit show state code.

Next 10 digit indicates PAN number.

Next 1 shows the serial number of GST registration in a state.

The Last 2 digits are random.

What's the composition scheme for GST?

The GST Composition Scheme is made for small taxpayers to make it easier for them to pay their taxes. Small taxpayers don't have to send in GST returns every month, and they only have to pay a small amount of GST based on their turnover. Under the composition scheme, any business with an annual turnover of up to Rs. 1.5 crore can register for GST.

Regular Scheme

Compliance: Normal compliance is required.

Tax Rate: The tax rate on goods and services for regular taxpayers, which ranges from 0 to 28%.

Input Tax Credit: The input tax credit benefit can be used by regular taxpayers.

GST Return Filing: Normal taxpayers have to file a return every month.

Tax Invoice: Customers can get tax invoices from normal taxpayers.

Composition Scheme

Compliance: relaxed compliance rules to protect small businesses.

Tax Rate: Taxpayers have to pay a nominal GST at a fixed rate of turnover, which is usually between 1% and 5%.

Input Tax Credit: Composition taxpayers can't use the benefit of the input tax credit.

GST Return Filing: Taxpayers are required to file a return every three months.

Tax Invoice: Composition taxpayers can't give their customers tax bills.

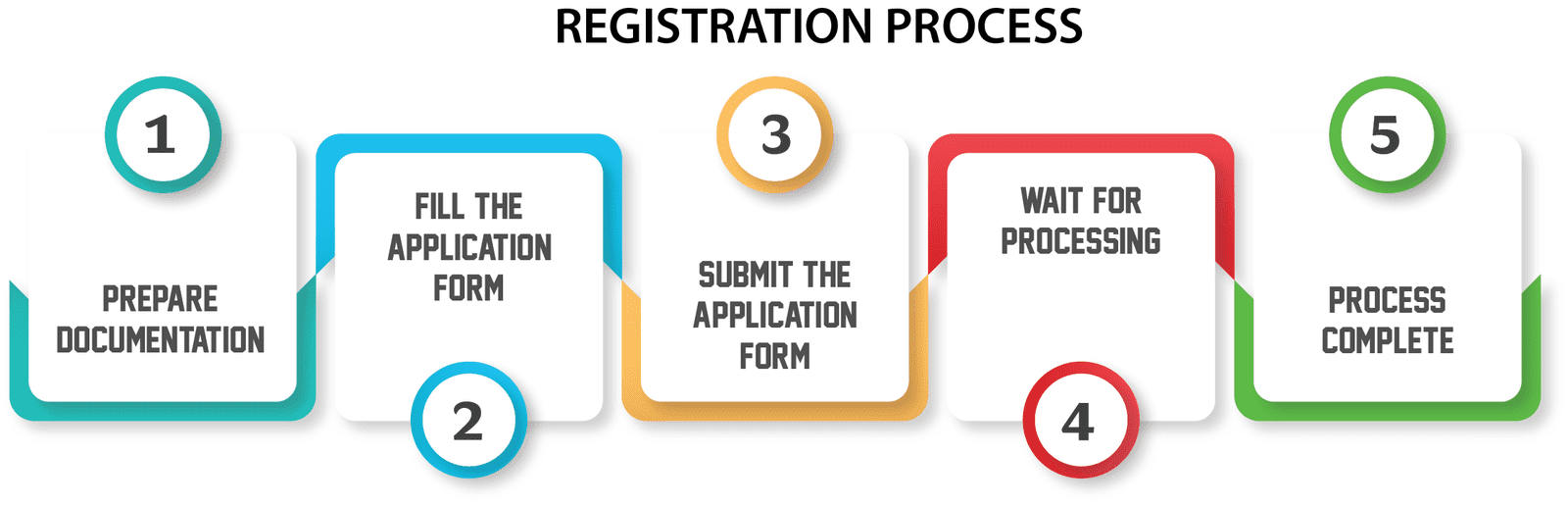

The Procedure for Registering for GST

1. Give our web portal the necessary business details and information.

2. You can choose a package and pay online in a number of ways.

3. When you place an order, your application will be given to one of our dedicated professionals.

4. Our professionals will carefully look over the documents to make sure they are correct and accurate, and then file the GST application form.

5. Our professionals will keep in touch with the government department to make sure that the online application for GST is being processed.

6. When you get your GSTIN, we will send you a GST certificate, along with several eGuides on GST and GST Invoicing Software.

Documents needed to register for GST

PAN card of the applicant or the business: The business's GSTIN is linked to its PAN. So, you need a PAN in order to get a GST certificate.

Proof of a promoter's name and address: All of the promoters must turn in documents like a PAN, passport, driving license, Aadhaar card, or voter ID card.

Address Proof for Business Location: For the address on the GST application, you must send in documents like a rental agreement or a sale deed, as well as copies of your electricity bill, latest property tax receipt, or municipal khata.

Bank Account Proof: A scanned copy of the first page of the bank's passbook showing a few transactions and the business's address must be sent for the bank account listed in the registration application.

What's the GST?

GST stands for Goods and Services Tax. It is a type of indirect tax that must be collected from customers when you sell goods or services and sent to the government.

When do you have to register for GST?

It is necessary to register for GST if:

1. If your annual sales exceed INR 40 lacs or

2. If you sell across state lines or

3. If you sell products online through an e-commerce portal, registering under GST helps you get your business recognized as a legal registrant and gives you access to a number of benefits, such as being able to raise GST invoices, get input tax credits, and much more.

4. If you buy or sell things from or to other countries,

5. If you want to send a tax bill to one of your clients,

6. If a business is taking part in an exhibition or event outside the state as a "casual tax payer,"

Can I sign up for the GST on my own?

Yes, you can sign up for GST on your own even if your annual sales don't meet the minimum amount (40/20 lacs).

When does a company need more than one GSTIN?

If a business sells goods and services in more than one state, it must register under the GST in each of those states.

Also, any business can get more than one GSTIN, even if it does business in the same state but in different areas. This is to make accounting easier for businesses that do different things.

Illustration

The only place where XYZ Private Limited does business is in Bangalore, where they sell goods and software. Still, a business can apply for more than one GST number for its different areas of business.

If you sell goods and services from one state to the whole country of India, There is no need for more than one GST certificate.

Is there a penalty if I don't sign up for GST?

Any business that has to register under GST but doesn't or chooses not to will have to pay a penalty of 100% of the tax owed or INR 10,000, whichever is higher.

What information and documents are needed to sign up for GST?

Depending on what business you are running, you may need different documents. The following documents are needed to sign up for GST:

1. Passport Photo Dimensions

2. Aadhar card, passport, or driving license

3. The company's business card

4. Proof that a business is at a certain address

5. A statement from your bank, a cancelled check, or a passbook

ADDITIONAL DOCUMENTS FOR A PRIVATE LIMITED COMPANY, LLP, OPC, OR PARTNERSHIP FIRM

1. Certificate of Incorporation for Company, OPC, or LLP

2. In the case of a partnership firm, the partnership deed