What is a registration for a partnership firm?

Partnership firm registration is the process of incorporating a partnership firm, which is a business with unlimited liability made up of partners who work together to achieve a common goal.

How does a partnership firm work?

A partnership firm is a type of business where two or more people work together to do business on terms that everyone agrees on. In the partnership deed, these agreements are written down. Before the partnership registry accepts the partnership deed, the partnership firm registration is not complete.

Here are some things to look forward to if you want to register a partnership firm online in India:

1. There must be at least two partners.

2. The partners may or may not share in the business's responsibilities.

3. The partnership lets you put more money into the business.

4. In a partnership, risk is shared.

5. It's not necessary to send in annual returns.

6. The partnership deed registration must state all of the tasks that this business does, how the profits are split among the partners, and what each partner handles.

Conditions for registering a partnership in India

Here are the requirements to be able to register a partnership in India:

1. There have to be at least two partners.

2. The partners might or might not share the business's responsibilities.

3. In a partnership, each party shares the risk.

4. All partners must agree to the terms in the partnership agreement.

Who has rights, and who is responsible?

In accordance with the Partnership Agreement,

1. A member partner has no right to get paid for helping to run the firm's business.

2. Each member partner is entitled to an equal share of the profits and losses, if any, of the business.

3. A partner who is entitled to interest on the money he puts in can only get that interest out of the profits.

4. Let's say a member partner puts more money into the business than the amount of capital he agreed to put in. In that case, he is owed the interest at 6% per year.

5. A partnership firm can reimburse a partner for payments he made and debts he took on for the following reasons:

1. To run the business well, and

2. To keep the business from losing money, like a sensible person would do in his situation and in similar situations.

A member partner can also make up for any harm done to the business by being willfully negligent.

Estate Partnership

1. According to the partnership agreement, the firm's property must include all property and rights and interests in property that were originally brought into the firm's stock. The firm or someone working for the firm can buy or get the property in other ways. The property can be bought as part of the business, and this includes the goodwill of the business.

2. Unless it seems otherwise, property, rights, and interests in property bought with the firm's money must be bought for the firm.

3. According to the agreement between the partners, the business's property must be held and used only for the business.

agreement among the member partners to share profits

According to the Partnership Agreement,

1. If a partner makes money from a transaction with the firm, he has to report it and give the money to the firm.

2. If a partner runs a business that is similar to the firm's or that competes with it, he must report and pay all profits to the firm.

Agent of the firm as a member partner

1. A partner's actions in running the business of the partnership bind the partnership. "Implied authority" refers to a partner's ability to bind the business.

2. A partner's implied authority does not give him the power to:

a. Take a business dispute involving the firm to arbitration.

b. Set up a bank account for the company in his name.

c. The firm can settle or give up any claim or part of a claim.

d. Pull a lawsuit or other legal action filed on behalf of the firm.

e. Admit any fault in a lawsuit or other legal action against the firm.

f. Buy real estate on behalf of the company

g. Sell or give away the firm's real estate

h. Make a partnership deal on behalf of the company.

Documents needed for partnership registration in India

In India, the following papers are needed to register a partnership:

1. An application for registration of a partnership firm on Form I

2. A properly filled sample affidavit

3. A certified copy of the partnership deed, printed on the right kind of non-judicial stamp paper.

4. Proof of ownership or a rental or lease agreement for the business location

5. Attach a court fee stamp and pay the required registration fee for a partnership firm by demand draft.

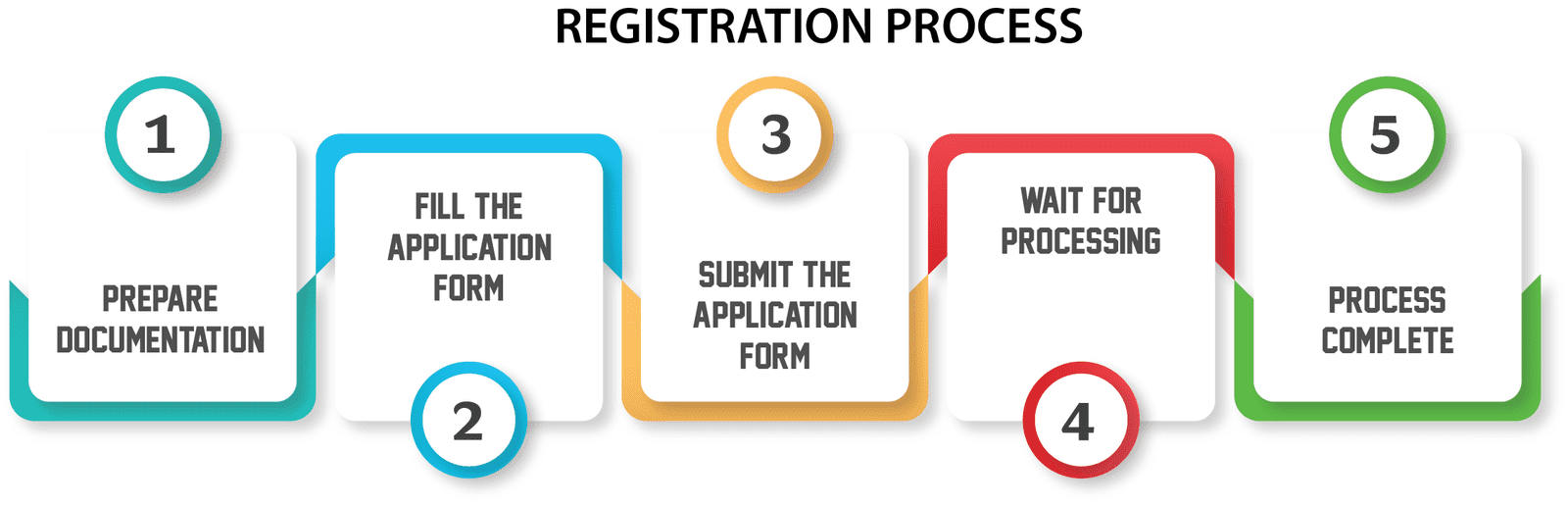

How to Register a Partnership in India

Each state has its own procedure for registering a partnership firm. In some places, partnership registration can be done online. Most of the time, though, the process of incorporating is still done offline. The Partnership Registration Act is old, which is why this is the case. It was started in 1932, and nothing has changed about it since then.

So, here's what you need to do to register a partnership company:

First, partners for the process are chosen.

2. An initial draft of the partnership agreement is made.

3. The draft is changed to meet the needs of the partners.

4. An application is sent to the office of the partnership registrar (you can register your partnership deed online if your state lets you).

5. The registrar looks at the application and the partnership agreement.

6. A certificate of registration for the partnership is given, and the partnership deed is certified.

After getting the certificate of registration for a partnership firm, you can start your business right away.

It's not easy to register a name for a partnership firm. The experts at Certpedia will assist you in any way they can. With our partnership registration services, you can quickly start a business as a partnership firm.

Partner of a Firm Introduced

1. A person can become a partner in a business if all the other partners agree to it.

2. When someone is brought into a business as a partner, they are not responsible for anything the business did before they joined.

Partner Leaving the Company

A partner can retire.

1. With the agreement of every other partner

2. According to a clear agreement between the partners

3. By telling all the other partners in writing that he wanted to leave the business.

A retiring partner can avoid liability to a third party for actions taken by the firm before he left by entering into an agreement. Such an agreement can be inferred from the way a third party dealt with the reformed firm after he knew about the retirement.

Partner was fired

A partner can't be kicked out of a business by most of the partners unless they are acting in good faith or have the power to do so because they agreed to it in a contract.

Partner declares bankruptcy

1. If a partner in a firm is found to be insolvent, he stops being a partner on the date the order of adjudication is made, regardless of whether the firm is dissolved or not.

2. When a partner is ruled insolvent but the contract between the partners is not broken, the partner's estate is not responsible for anything the firm does. Also, the firm is not responsible for anything the bankrupt person does.

We can help Indian businesses register as partnerships.

At Certpedia, we help with partnership registration in India from start to finish. Our services include:

1. Getting together basic facts

2. writing up the partnership agreement.

3. Looking over the application and making any necessary changes

4. Sending in the final deed and the application to register as a partnership.

Certpedia is a top legal consulting firm that offers a full range of services for registering partnerships. Our professional team will help you with everything you need to register a partnership firm smoothly.