What does it mean to modify the GST?

A "GST modification" is any change or alteration made to the GST registration or the information entered in the GST certificate. One can choose to amend his GST registration if he wants to switch from a composite scheme to a normal scheme or if there are mistakes in it. To change your GST, you need to file Form GST REG 14.

What was the GST Modification Amendment?

Since the start of the GST regime in 2017, taxpayers have been able to sign up under two schemes: the normal scheme and the composite scheme. One could also switch from a normal to a composite scheme.

But the government said that the deadline to get GST registration under the composite scheme by filing Form GST CMP-02 was March 31, 2018. Now, you can't switch from the normal scheme to the composite scheme, but you can do the opposite with a GST modification.

Who can get a modification to their GST?

Whoever has an application for GST that is currently being handled and whose company is already registered under GST can participate.

What exactly can be changed?

Details like the name and location of the business, the addition or removal of partners or directors, and the contact information of the person who is authorized to sign.

Voluntary modification

If an error is found in a GST certificate or a change is needed, GST modification can be done right away.

Other changes

If there are any other details that need to be changed, the only thing that needs to be done to change GST is to file GST Reg 14.

Change in the Company Name

If the name of a business firm or company changes, it should be updated right away with the GST modification.

Can PAN Be Changed?

No. If a business firm's PAN number changes, it can be updated with a new GST registration.

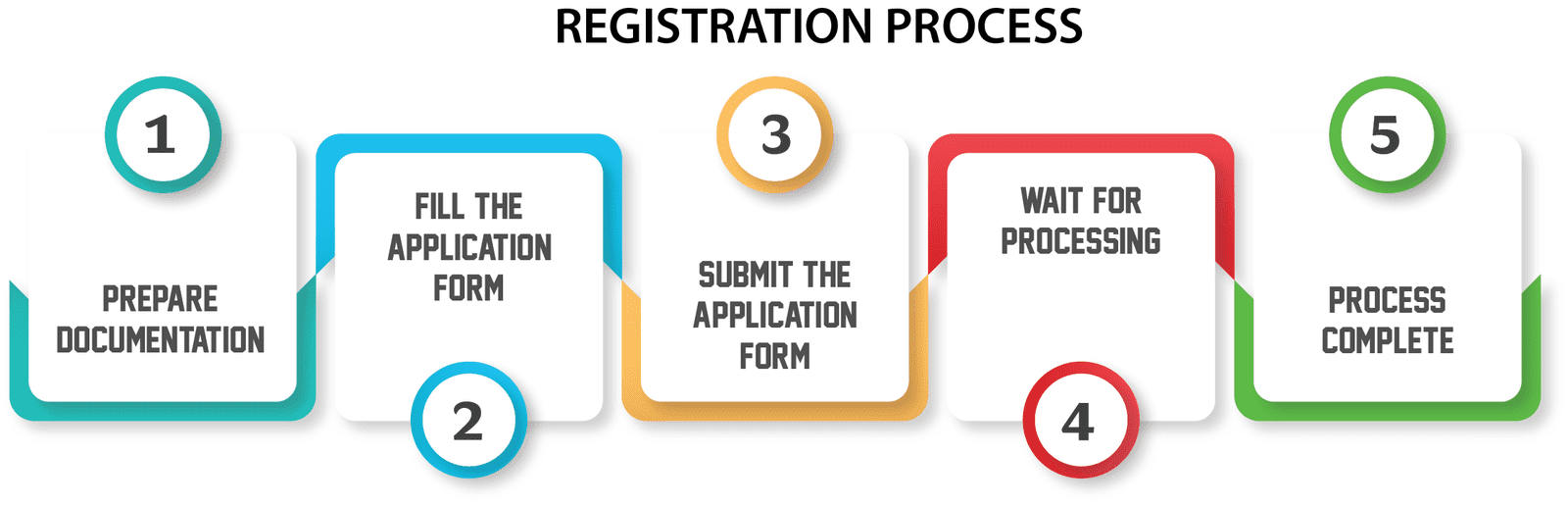

The GST Modification Process

1. Please provide the necessary business facts and information to be entered into our web portal.

2. Choose a package and pay online using one of the different payment methods that are available.

3. When you place an order, your application will be given to one of our dedicated professionals.

4. After you send in all of your information, Form GST REG 14 will be filed.

5. Our professionals will keep track of the online processing of GST application changes.

6. After the GST officer checks the GST REG 14, the GST REG 15 form will be given.

DOCUMENTS REQUIRED FOR GST CHANGE

1. Documentary proof of change.

2. GST Certificate.