Types of GST Returns

GSTR 1

The goal of this return is to give information about all sales, whether they were made to businesses or directly to consumers. The due date for this return is the 10th of every month, or the end of the next month for quarterly returns.

GSTR 3B

This is a summary return that shows the details of the net tax liability based on output and input tax. The due date for this return is the 20th of every month.

GSTR 4

A business that chooses the composition scheme must pay to subsidize GST rates from 1% to 5% and file this quarterly return.

GSTR 1A

The purpose of this return is to fix the fact that your customers' tax invoices don't match up with your sales figures.

GSTR 8

Under GST, an e-commerce business that needs to collect TCS (Tax Collected at Source) has until the 10th of every month to file this return.

GSTR 9

This is the Annual GST Return, which all registered people have to fill out by March 31 of each year.

Why should you file your GST returns on time?

Avoid Penalty: If you don't file your GST returns on time, you'll have to pay a fine of INR 200 per day and up to INR 5,000 for each return.

Avoid Registration Cancellation: Worst case, if you don't file your GST returns on time, your certificate could be canceled.

Better relationships with your prospects: If you file your GST returns on time, your customers will be able to claim input credits easily, which will help you maintain a good relationship with them.

Better Compliance Rating: The Indian government wants to start a compliance rating system that will keep a scorecard for every GST registrant. In fact, one of the most important factors in figuring out this rating is how quickly the GST return is filed.

Ease of availing loan: It's clear that a taxpayer's ability to get a loan from a bank or other financial institution depends on how quickly and accurately they file their GST Return. By looking at a taxpayer's GST returns, banks can figure out how trustworthy he is.

E-Waybill generation: In order to get businesses to follow the rules and file GST returns on a regular basis, the Finance Ministry has now made it harder for traders who haven't filed GST returns for two months in a row to create E-Way bills for shipping goods.

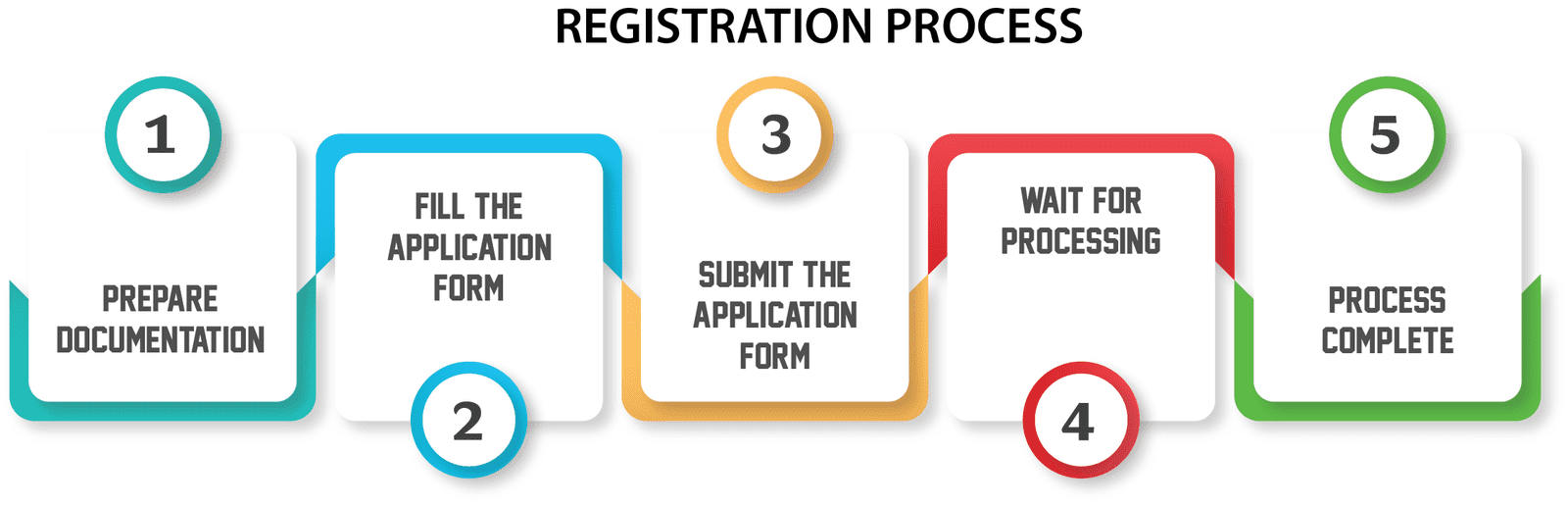

GST RETURN FILING PROCESS

1. Send required information and documents by mail

2. Choose a package and pay online using one of several payment methods.

3. When you place an order, one of our dedicated professionals is given your task.

4. Our professional will fill out the GST return and let us know how much tax we owe.

5. Our expert will file an online GST return with the GST department.

6. Share the acknowledgement receipt you got from the portal.

If you don't have any invoices or businesses, do you still have to fill out a GST return?

Yes. GST law says that GST returns have to be filed. It is required to file a GST return even if no transactions were made in the month. If you don't file your nil GST returns, you'll have to pay a late fee of $100 per day for as long as the delay lasts.

Do we have to upload all bills when we file our GST returns?

No. Whether or not you need to upload all invoices when filing your GST return depends solely on two things. Whether you're uploading a B2B or B2C invoice, if you're involved in supplies within the same state or between states,

In a B2B transaction, what GST invoices must be uploaded?

Whether it's an intrastate or interstate supply, all invoices for B2B sales must be uploaded. Only then can the recipient business claim the input credit.

In a business-to-consumer transaction, what kind of GST invoices must be shown?

In the case of business-to-consumer (B2C) sales, invoices may not be necessary if the customer doesn't take input credit. So, in that case, invoices with a total value of more than Rs. 2.5 lacs must be given for B2C sales between states. If the interstate invoice is less than 2.5 lacs and the supply is within the same state, a state-by-state summary will be enough.