About Import/Export Codes

Import Export Code, which is often shortened to IEC, is the first registration that businesses which import or export goods and services from India must get. The Directorate General of Foreign Trade puts out IEC (DGFT). It is a business passport for importing and exporting.

Import-Export Code Registration: Key Points

When is the IEC needed? The Import Export Code is needed when importing or exporting goods and services in India.

Issuing Organization: The Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industries, Government of India, is in charge of giving out IE codes.

Needs to be Renewed Every Year: The IE Code is no longer a one-time process. Import Export Code requires annual renewal.

No Returns: The IE Code doesn't require any return to be filled out or any other procedures to be followed.

Customs and Banks Requirement: The IE Code says that you have to get a quote from customs and banks before you can import or export goods or pay or get paid by international vendors.

AD Code: An authorized dealer code is needed for customs clearance when exporting goods outside India. You can get it at the bank.

IS THE IEC CODE LICENSE REQUIRED FOR EXPORT SERVICE PROVIDERS?

The Import Export Code (IEC) license is a key business identification number that is required for exports and imports from India. Without an IEC Code Number from the DGFT, no business can import or export.

When importing or exporting services or technology, the IEC Code is only needed if the service provider or technology provider is looking for benefits under the Foreign Trade Policy or dealing with certain services or technologies under Section 7 of the Foreign Trade (Development and Regulation) Amendment Act, 2010.

An Import Export Code Exemption can be given to the following parties:

1. Ministries or government departments at the federal or state level

2. People who bring things into or out of the country for their own use that have nothing to do with trade, manufacturing, or agriculture.

3. People who import or export goods from or to Nepal, Myanmar, through the border areas between India and Myanmar, or China, as long as the CIF value of a single shipment does not exceed Rs. 25000. For the Nathula port, the exemption ceiling is Rs. 1 lakh.

IEC Number Exempted Categories.pdf has the rules for getting an Import Export Code Exemption.

A digital signature is needed for the import-export code.

Import-Export Codes can be applied for online by both importers and exporters. So, the business owner or director needs a digital signature for the import-export code.

Digital signatures (DSC) are the best way to apply for the online IEC code application.

The DGFT also has a unique digital signature certificate that it gives to organizations that already have an IEC code for export and import. Applicants can save up to 50% on license fees if they use this one-of-a-kind DSC.

Certpedia can help set up a digital signature [DSC] for the applicant.

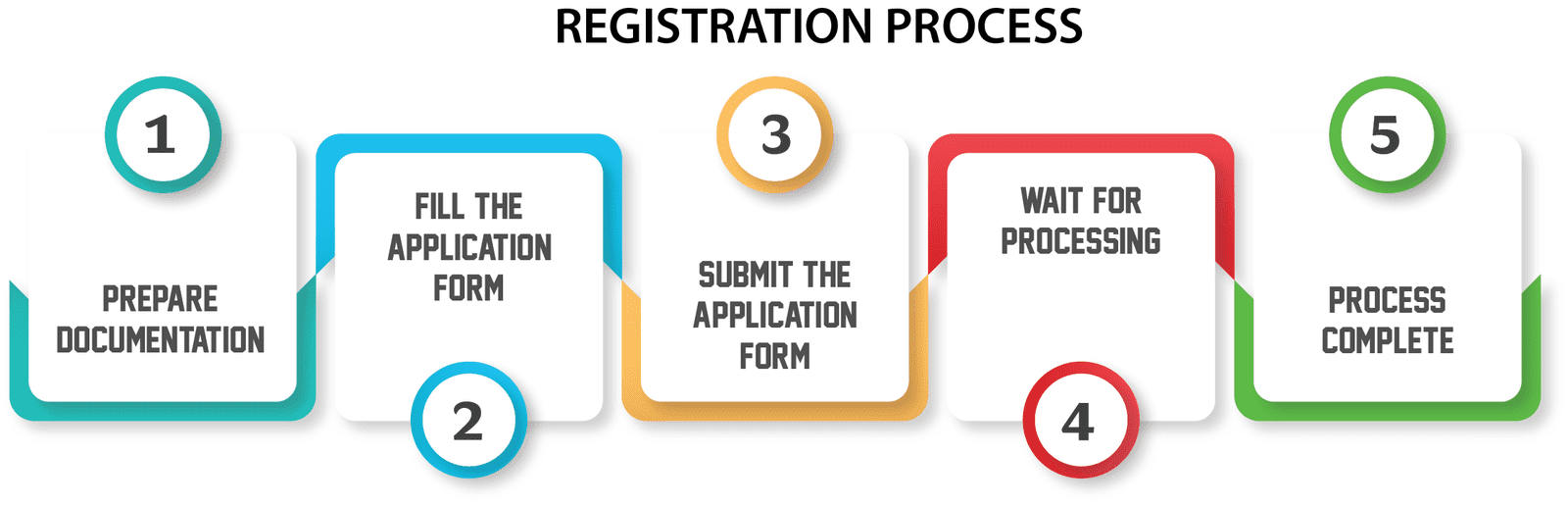

IEC Registration Process

1. Put the documents and information we need on our website.

2. Pick a package and pay online. There are different ways to pay online.

3. Our expert will put together the application in the format required by IE Code.

4. Attach the applicant's digital signature to the online application and send it to the DGFT.

5. Officials from the DGFT will check the application and handle it within a week.

6. After the verification is completed successfully, send the Import-Export Code certificate via email.

WHAT DOCUMENTS DO YOU REQUIRE FOR AN IMPORT/EXPORT CODE?

1. A photo the size of a passport

2. Card PAN

3. Details about a bank account

4. Check with pre-printed cancellation

5. A letter from the bank

6. Proof of address

What is the Export Promotion Capital Goods (EPCG) Program?

The Export Promotion Capital Goods (EPCG) Scheme, as the name suggests, is a way for the government to try to increase exports.

The EPCG Scheme lets you import capital goods, like spare parts for pre-production, production, and post-production, with no customs duty. However, you have to export six times the amount of duty you saved on capital goods imported through the EPCG scheme within six years of the date you got your authorization.

This scheme can be used by manufacturers, exporters, and merchant exporters.

A service provider who has been recognized as a Common Service Provider (CSP) can also use the scheme.

You can use the EPCG Scheme with an Import/Export Code by sending an application from Appendix 10A of the Handbook, along with the papers it asks for, to the Director General of Foreign Trade (DGFT) or to the regional licensing authorities, along with the relevant information and documents.

Here are the rules and responsibilities of the EPCG Scheme:

1. The obligation to export must be met by exporting goods that were made or made possible by using the capital goods that were brought into the country as part of the scheme.

2. Exports should be done directly under the name of the person who is bringing the goods into the country. The importer can send the goods out through a third party as long as that third party is listed on the shipping bill as the importer or license holder. If a trader-exporter is the importer, the brand name should be on the shipping bill.

3. The money from exports must be paid back in a currency that is easy to exchange.

4. Exports are things that leave a country. The export requirement will also be met by deemed exports, but the licensee has no legal right to any benefit from deemed exports.

5. The obligation to export is in addition to the importer's other export obligations, and it is more than the average value of the product he has exported over the past three licensing years. If an exporter can reach an export amount of 75% of the total value of production of the products being exported, then the obligation to export is included in that export. However, the value of those exports must not be less than the total value of the contract during the set time period.

6. If the exporter manufacturer has licenses to make the same export item under both this scheme and the duty exemption scheme, physical exports made under the duty exemption scheme will also count toward the export obligation under this scheme.

7. If computer software is sent out of the country, The policy will tell us if we have to export computer software, but we won't have to meet the requirement that exports should be more than and above the average of exports in the three licensing years before.

IEC CODE LICENSE HOLDER'S CERTIFICATE OF ORIGIN

An important international business document is a Certificate of Origin (CO). The Certificate of Origin proves that all of the goods in an export shipment were bought, made, or processed in one country.

In other words, the Certificate of Origin shows the "nationality" of the product and acts as a promise from the exporter to follow any trade or customs rules.

COs are needed by customs, banks, private parties, and importers for many different reasons. Also, almost every country in the world needs a CO for customs clearance. This means that anyone with an IEC Code License who wants to export outside of India must also apply for a Certificate of Origin.

The Indian Chamber of Commerce and the Trade Promotion Council of India both give out Certificates of Origin. Also, people who have an Import-Export Code License can get two kinds of Certificates of Origin.

1. A non-preferential certificate of origin says that the products being exported or imported do not get preferential tariff treatment and that the correct fees must be paid for the items being shipped.

2. Preferential Certificates of Origin are given to goods that get special treatment when it comes to paying tariffs. Preferential Certificates of Origin (POs) help verify goods that can be exported to countries with lower taxes or allowances. Regional trade agreements are often linked to these COs.