What is the definition of sole proprietorship in India?

In India, a sole proprietorship business is the simplest type of business structure. It is owned, run, and controlled by the sole owner. A sole proprietorship is not a legal entity; it just means that one person owns the business and is personally liable for its debts. This is one of the most popular types of business structures for micro and small businesses in the unorganized sector because it is simple, easy to get information about, and doesn't cost much. All of these things make getting a certificate of incorporation for a sole proprietorship a good idea.

But getting a certificate of sole proprietorship is usually not a good idea for medium- and large-sized businesses because it has a number of drawbacks, such as unlimited liability, no separate legal entity, the inability to transfer ownership, and a limited life.

The Indian government hasn't set up a way for a sole proprietorship firm to get registered. So, the only way to prove the registration of a sole proprietorship is through the tax registrations that the business is required to have by law. These tax registrations may include GST Registration, which must be gotten in the name of the Proprietor to show that the Proprietor is running a business as a sole proprietorship.

How is registering a sole proprietorship firm different from registering other types of businesses?

When you apply for a sole proprietorship online, you have a different idea of what a business is than most people do. You're not looking for a strong structure; instead, you want a more flexible way to run your business.

Simply put, you're thinking about firm registration for a proprietorship because it's different from other business entities in India in the following ways:

No regulatory authority: Unlike most types of business registration in India, a sole proprietorship isn't regulated by any government agency. No one other than the standard income tax department watches over people who have a sole proprietorship license, which is a term we use very loosely.

No requirement for annual compliances: One thing that makes a sole proprietorship unique is that it doesn't have to do anything every year, unless you count filing annual income tax returns. In fact, people often ask, "Do I need to register my sole proprietorship in India?"

Nobody to hold your hand: Without a governing body, you can't follow many rules. And without regulatory compliance, you don't know the limits of how you can run your business. If you want to register a sole proprietorship business in India, you have to learn everything by yourself.

No agreement says how you run your business: There is no memorandum of association for a sole proprietorship. Traditionally, a memorandum of association is the most important document that explains the purpose of your business. There is some kind of legal document that says what the business is when you register it online as a sole proprietorship, but it is not as strong as an LLP Agreement or Memorandum of Association.

There is no certificate of registration for a sole proprietorship: In India, there is no such thing as an "ownership firm registration certificate." Also, there is no ownership register either. So, how does a sole proprietor show that they own a business? Without a certificate of proprietorship registration, it can be very hard. Isn't it? Not at all. All you need is a bank account in the name of your company to prove that you have registered a sole proprietorship firm online.

There are no rules about what a sole proprietorship can be called: There is no concept of registering a business name. You can call your sole proprietorship anything you want, including your own name.

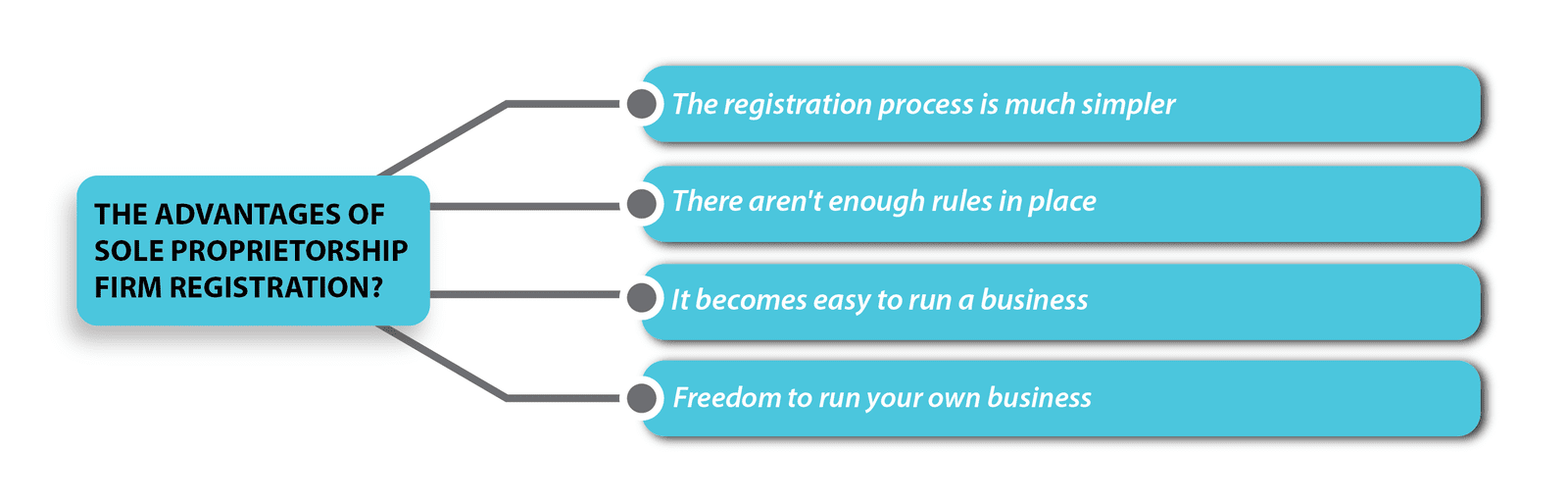

What are the advantages of sole proprietorship firm registration?

After registering a proprietorship firm in India, you have access to the following benefits:

The registration process is much simpler: In India, you have to do things differently to register a sole proprietorship business because there is no governing body. All of the steps are pretty easy, and they all involve sending an application to your local office.

There aren't enough rules in place: Due to the lack of oversight, there aren't many rules for you to follow. You just have to fill out your income tax returns each year, or GST returns if you make more than enough, and you're good to go.

It becomes easy to run a business: As a business registration with one owner, a "sole proprietorship" is easy to run. You don't have to think about a lot of different things. Usually, only small shops register as sole proprietorships. So, you don't have to worry about much infrastructure besides some of the back-end finances.

Freedom to run your own business: Since you can start your business on your own, you are free to run it in any way you want. Think of a sole proprietor as a lone ranger in a forest of business entities who can run his business without being bothered by rules that aren't necessary.

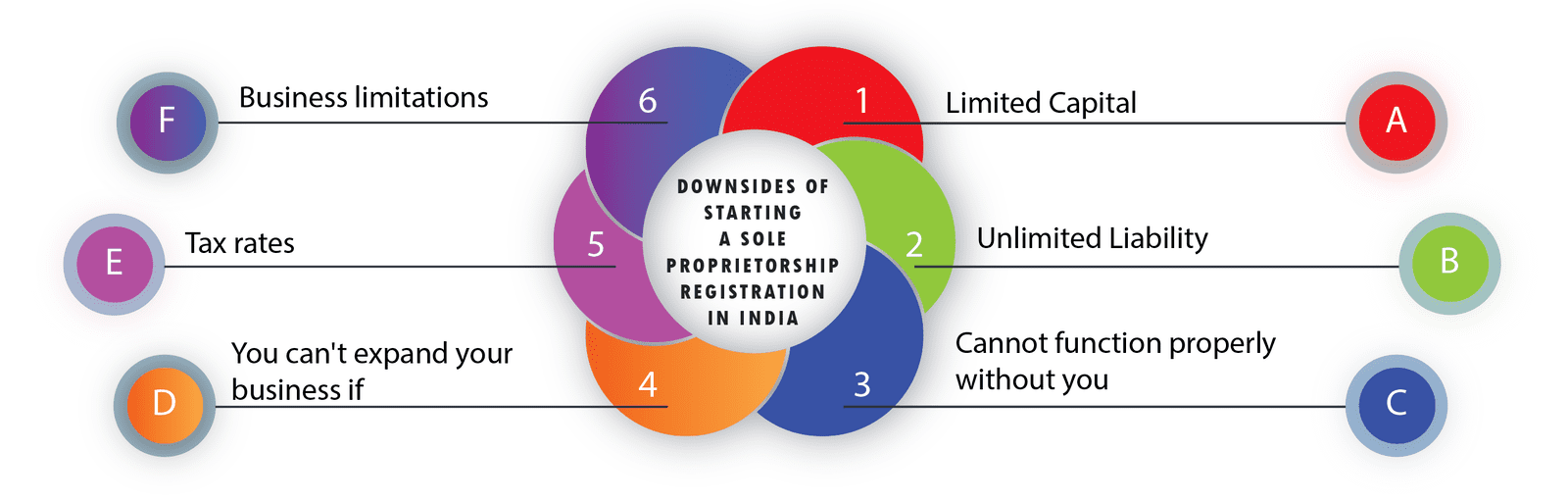

Downsides of Starting a Sole Proprietorship Registration in India

Limited Capital: When registering a sole proprietorship, keep in mind that you will be responsible for all the costs of your business. And as an individual, it would be hard to get money. It limits the amount of capital that a sole proprietorship business can get.

Unlimited Liability: You are not different from a sole proprietorship. And since your business isn't a separate entity from you, all of its debts fall on you. The fact that you can be held responsible for anything takes away any sense of security from your business. You can't make mistakes because they can mean the end of your business.

Cannot function properly without you: People often ask, "Do I have to register my business as a sole proprietor in India?" As soon as you leave the proprietorship firm, your business ceases to exist.

You can't expand your business if: You are the only one who can run this business, so don't expect any changes when it comes to doing business in India.

Tax rates: Your earnings will be taxed as personal income. As a sole proprietorship, your business won't get many government benefits, such as health insurance for your employees and more.

Business limitations: Because of the infrastructure, or lack thereof, there are limits to the kinds of businesses you can run as a sole proprietor. You can't get involved in complex projects; you have to stay within your abilities.

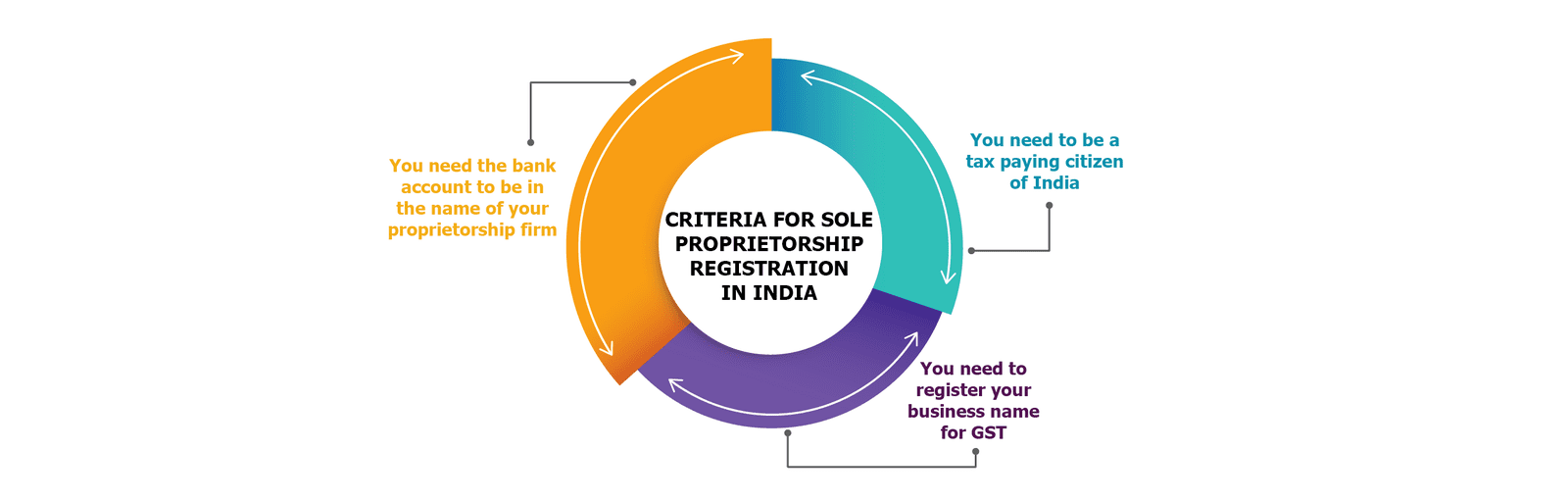

Criteria for Sole Proprietorship Registration in India

Since the government doesn't consider a sole proprietorship to be a legal business entity, it hasn't made it clear how to start one. So, if you want to be a sole proprietor, you must meet all of the following requirements:

You need to be a tax paying citizen of India: Online registration for a sole proprietorship firm is only available for those who are running a local business. If you do, and only then, you can start a proprietorship firm. The government of India thinks this business entity is too free, so only people from India can start it.

You need to register your business name for GST: If your business's annual sales are more than INR 40 lakh, you must get a GST registration certificate in India. It will act as proof for your business.

You need the bank account to be in the name of your proprietorship firm: One of the requirements for sole proprietorship firm certification is that you must open a bank account in the name of your business. It will help you keep your business finances in order.

What Documents Are Needed to Register a Sole Proprietorship in India?

The documents you need to register a sole proprietorship include the registrations you need to give your business a name.

So, you'll need these two things:

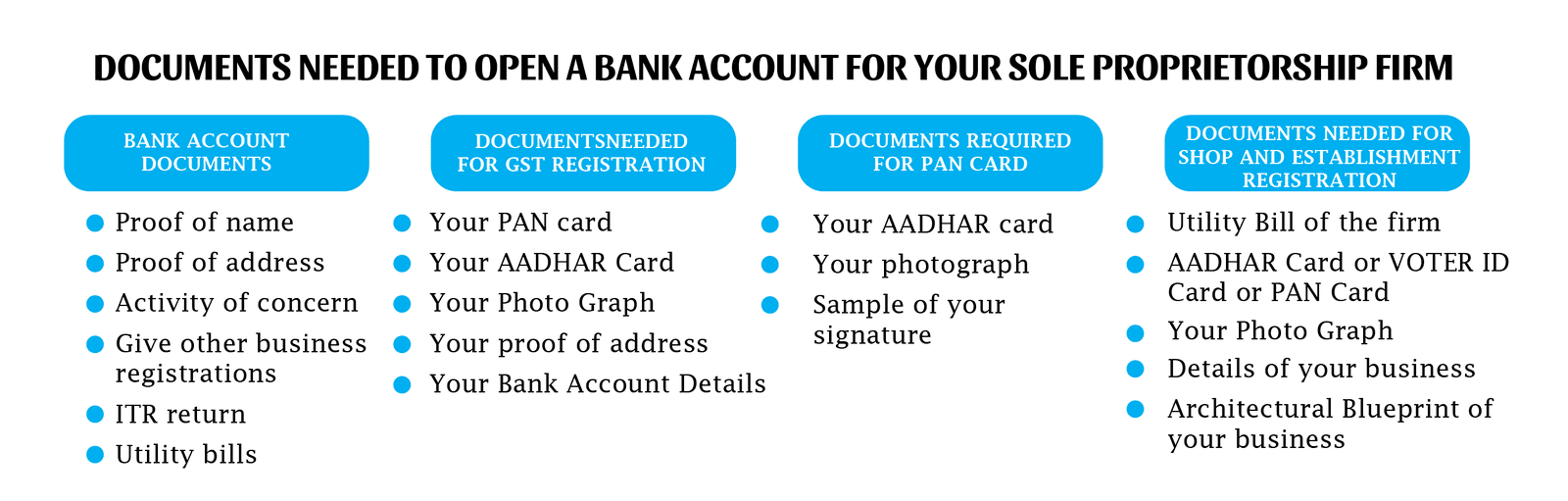

1. documents needed to open a bank account for your sole proprietorship;

2. documents needed for a sole proprietorship to register for GST.

3. documents that are needed to get a PAN card.

4. documents needed to register shops and businesses

Documents needed to open a bank account for your sole proprietorship firm

Proof of name: Provide proof of the name of your sole proprietorship.

Proof of address: Give the address of the company that owns the property.

Activity of concern: Give specifics about your business goal. You can either use an existing invoice or write up a full description.

Give other business registrations: Send the banks copies of your business's registration certificates.

ITR return: Copy of your tax return from last year

Utility bills: Give a copy of the utility bill to backup your proof of address.

Documents needed for GST registration

Your PAN card

Your AADHAR Card

Your Photograph

Your proof of address

Your Bank Account Details

Documents required for PAN card

Your AADHAR card

Your photograph

Sample of your signature

Documents Needed for Shop and Establishment Registration

Utility Bill of the firm

AADHAR Card or VOTER ID Card or PAN Card

Your Photograph

Details of your business

Architectural Blueprint of your business

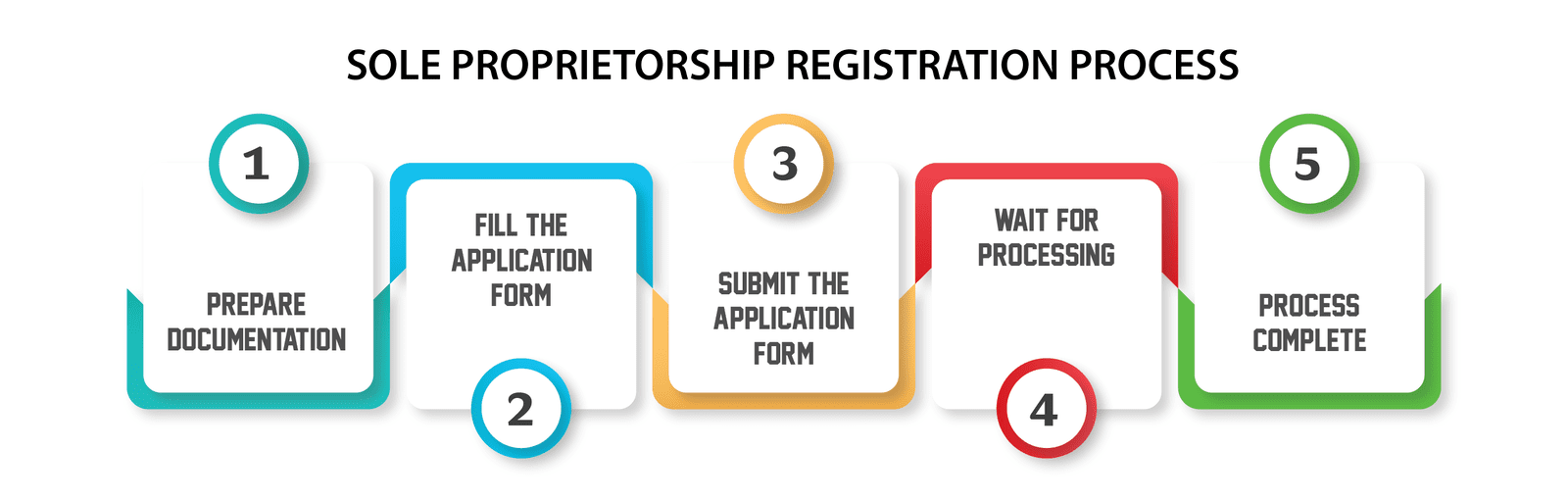

The Procedure for Establishing a Sole Proprietorship in India

Here is the answer to your question, which was how to start a sole proprietorship firm in India.

The procedure for sole proprietorship registration in India is as follows:

1. Make a decision on the name of the company.

2. Check to see if the name you have chosen for your business is already taken.

3. Fill out the online form to register for GST.

4. Upload the required documents.

5. Get the certificate of GST registration a few days after submitting the application.

6. Set up a bank account for the business under its name.

Note: There is no online sole proprietorship registration. It is just a marketing term meant to entice. In reality, if you want to start a sole proprietorship, you need to go to the authorities and give them the paperwork.

We can help you register as a sole proprietor in India.

We at Certpedia offer complete solutions for registering a sole proprietorship in India. Our services include:

1. Basic documents and information collected

2. Application drafting.

3. Reviewing the application and, if needed, making changes.

4. Getting you the certificate of GST registration and giving it to you.

5. Helping you get your shop and establishment registration certificate.

Certpedia is a leading legal consulting firm that offers all the services needed to turn a sole proprietorship into a corporation. Our expert team will give you all the help you need to register as a sole proprietorship firm quickly.