What's LLP Registration?

LLP registration is the process of forming a limited liability partnership. It is a business governed by the Limited Liability Partnership Act, 2008. In India, it needs at least two partners to be incorporated.

If you want to do business safely, you need to protect your assets. But if you choose a traditional limited company to keep your assets separate from your business, you lose some of the benefits of a partnership firm. So, is there a way to keep the benefits of a limited company while remaining a partner firm? Yes, there is one.

Let us explain limited liability partnerships.

A limited liability partnership is a type of business entity that looks like a partnership.

However, it does have the benefit of limited liability, which protects the assets of the LLP owners. The Limited Liability Partnership Act of 2008 made this type of business structure legal. It is the second most popular type of business infrastructure after a company. To start it up, you need to go through LLP registration in India.

A limited liability partnership (LLP) is different from a partnership in more ways than one. In a partnership firm, if one partner does something wrong, both partners are responsible. But one of the main benefits of LLP registration in India is that one partner's bad behavior won't affect the other partner.

The other parts of LLP are as follows:

1. It's a separate legal entity from its members.

2. Members can get access to limited liability.

3. A LLP is more adaptable than a partnership.

4. A Limited Liability Partnership Agreement is made and signed by the partners before the business is started.

5. It needs at least two designated members.

6. It falls under the Limited Liability Partnership Act of 2008.

What are the main advantages of establishing an LLP in India?

When you form a limited liability partnership in India, you get these benefits:

How easy it is to form an LLP: Forming an LLP is a simple process. There aren't many documents needed to set it up, and running it isn't too hard. All of these things make LLP the best choice for business owners with a lot of experience.

There is no minimum amount of capital needed to start an LLP. You need as little as $1 to do this. India's government has made it easier for both experienced and new business owners to set up this flexible business entity.

The cost to sign up is low: Low costs are involved in incorporating an LLP partnership. It has been done to promote this business entity among ambitious business owners who want to start a business and have the skills to grow it.

No limit on the number of partners: The fact that there is no limit on the number of partners is probably the best thing about an LLP Limited Liability Partnership. Your business entity can have as many partners as you want. It will give you endless ways to make money.

There is no need for a mandatory audit. Once you set up a business entity by following the steps for LLP company registration, you won't have to worry about auditing. Because LLP is a flexible entity, MCA has taken away any audit requirements that had to be met.

Savings from less compliance: Because you have to do less, you will keep more of the money you save. That alone is enough for an LLP to be registered in India.

Criteria for registering a limited liability partnership in India

Before you can apply for a certificate of incorporation, you must meet the following LLP registration requirements.

For an LLP to be formed, there must be at least two people. Without at least two people, a limited liability partnership firm cannot be made.

No minimum capital requirement: There is no minimum capital requirement to get the Limited Liability Partnership certificate. But you can't set it to zero because a certain amount is needed to make the stamp paper.

At least one of the LLP designated partners should be from India: An Indian business entity is an LLP. So, a new LLP can only be registered if at least one of the partners is from India.

To register an LLP, you must give it a unique name: When making a limited liability partnership, you can't ignore the fact that the name must be unique. Talk to experts about the best name for your business so you can register an LLP online.

Documents needed to register as a limited liability partnership in India.

Here are the documents that are needed to form an LLP.

1. Partnership with limited liability Proof that the partners meet the requirements

2. PAN Card Copy

3. Proof of identity (voter card, passport, driving license)

4. Proof of address (bank statement, mobile bill, telephone bill, electricity bill)

5. Passport-size photo

6. DPIN stands for "Designated Partner Identification Number."

6. DSC: Digital Signature Certificate

For Place of Business

1. Ownership documentation (electricity bill, gas bill, electric bill, mobile bill)

2. NOC (Download Format) (Download Format)

Note: Your registered office doesn't have to be a business. It can also be your home.

These documents are needed to register an LLP and are an important part of the process. So, don't start the process of incorporation until you've put these attachments together.

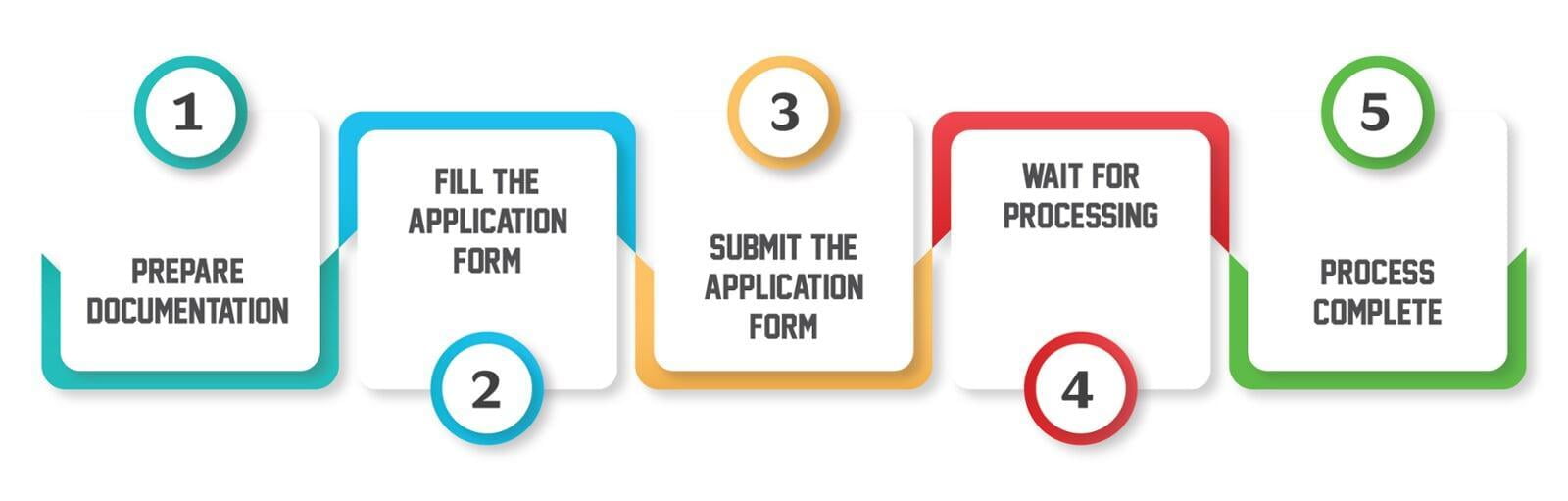

In India, How to Form a Limited Liability Partnership

In India, it is easy to sign up for a limited liability partnership. Because of this, many business owners find it easier to set up their companies as an LLP. Here's what will happen:

1. Get the members of the LLP's DSCs (digital signature certificates).

2. Fill out an application for the Director Identification Number and get it.

3. Make sure the name of the LLP is okay.

4. On the MCA portal, fill out the LLP registration form and upload the documents.

5. This process will make your LLP official. But it would only be temporary information because you need to write up an LLP agreement.

6. Send in the Limited Liability Partnership Agreement, or LLP Partnership Agreement.

The LLP Agreement spells out in detail what powers each partner in the LLP has. The Limited Liability Partnership certificate will be sent to you after you send in the agreement.

LLP Incorporation's registered office

1. A limited liability partnership must have a registered office where all communications and notices must be sent and received.

2. An LLP that is registered can change where its registered office is and let the Registrar know about it by filing a notice of the change. Any such change won't happen until the paperwork is filed.

3. Let's say that an LLP incorporation goes against any part of the Act. In that case, both the LLP and each of its partners could be fined a minimum of 2,000 rupees and a maximum of 25,000 rupees.

Financial Disclosure

Account books and an audit

1. The limited liability partnership must keep accurate records of its finances each year. The accounts must follow the double-entry accounting system and be based on either cash or accruals. Also, as required, the LLP registration must keep the same information at its registered office.

2. Within six months of the end of each financial year, every limited liability partnership must make a Statement of Account and Solvency for the year. The LLP must send in the required statement on the last day of the financial year, using the form that the authority gives them. Also, the account statement must be signed by the LLP's designated partners.

3. Every limited liability partnership must file the Statement of Account and Solvency with the Registrar every year by the due date and pay the fees.

4. The accounts of limited liability partnerships must be audited according to any rules that may be set.

Note: The Central Government can exempt one or more types of LLP registration by putting a notice in the Official Gazette.

5. Any limited liability partnership that does not follow the rules will have to pay a fine of twenty-five thousand rupees. This fine can also go up to five lakh rupees. Furthermore, each designated partner of such an LLP will be fined at least 10,000 rupees and up to 1 lakh rupees.

Annual Returns

1. Every LLP that is registered must file an annual return with the Registrar within sixty days of the end of the financial year. This must be done in a way that is specified by the authority and includes a fee.

2. Any limited liability partnership that doesn't follow the rules will have to pay a fine of at least Rs. 25,000 and as much as Rs.

3. If the limited liability partnership doesn't follow the rules, the designated partner will have to pay a fine of at least 10,000 rupees and no more than 100,000 rupees.

Inspection

1. Any person picked by the authority to do an inspection must be able to look at the LLP incorporation document, the names of partners, any changes made to the Statement of Account and Solvency, and the annual return that each limited liability partnership files with the Registrar.

Penalty for a false statement

If a statement is made in a return, statement, or other document that the Registrar requires for inspection:

a) is false or knows it is false,

b) Which omits any important fact despite knowing it is important.

Then he will be sent to jail for a period that could go up to two years. Also, he could have to pay a fine of at least one lakh rupees and up to five lakh rupees.

Power of the Registrar in case of an LLP

1. The Registrar can ask anyone, including a current or former partner, a designated partner, or an employee of a limited liability partnership, to answer any question, make any declaration, or give him any details or particulars in writing within a reasonable amount of time.

2. Let's say that a person doesn't answer that question, make that statement, or give those details or particulars to the registrar within a reasonable amount of time, or if the registrar isn't happy with the answer or details that person gives. In that case, the registrar can call that person in to make a statement or give more information.

3. Anyone who doesn't respond to a summons or request from the Registrar will have to pay a fine of at least 2,000 rupees and up to 25,000 rupees.

Compounding of offenses: The central government can only "compound" a crime that is punishable by a fine by taking money from the person who is likely to have done it. The fine could be as high as the maximum amount allowed for the offense.

In case of default

If any registered LLP fails to do any of the following:

1. Any part of the LLP Act or any other law that says a return, account, or other document must be filed with the Registrar OR

2. Any request to the Registrar to change, finish, and resubmit a document or a new document

Let's say that the LLP fails to make up for the mistake. If that happens, the registrar can ask the tribunal to issue an order telling the LLP registration or its designated partners to fix the problem within a certain amount of time.

Our Help with Limited Liability Partnership Registration in India.

We at Certpedia offer end-to-end solutions for limited liability partnership registration in India. Our services include:

1. DIN, DSC, and Name Approval

2. Sending in a Form

3. Reviewing the application and making changes as needed

4. Getting the Certificate of Incorporation and giving it to you

So, if you want to form a limited liability partnership but don't want to pay a lot for professional help, call Standard Solutions.