Change India Partnership to LLP

A partnership firm is a business that is owned by more than one person. In a partnership business, each partner helps with all parts of the company. The partners also share the business's profits and losses. On the other hand, an LLP, which stands for "Limited Liability Partnership," is a business arrangement in which all partners have limited liability. One partner is not responsible for the diligence or carelessness of the other.

So, if you want to be on the safe side when doing business, it's a good idea to change your partnership into a limited liability partnership. By doing this, you will combine the limited liability part of a company with the partnership part of a firm.

Benefits of switching to an LLP

1. The main reason partners want to switch from a partnership to an LLP is for limited liability protection.

2. It's an interesting choice for small and medium-sized businesses because it's a great way to bring business synergies together.

3. It creates a simple working condition that limits partners' liability.

4. A LLP's existence and ability to run don't depend on just one of its partners. For example, if a partner in a partnership firm dies, the company might fall apart. In LLP, it may not stop existing in this situation. Partners in an LLP can come and go at any time, and it won't change how the LLP works.

5. Partners in an LLP are only responsible for the amount of capital they put in. There is no minimum amount of money that can be put in.

6. In a partnership firm, there must be at least two partners and no more than ten. In an LLP, on the other hand, there is no limit on the number of partners.

7. Unlike partnerships, LLPs can be merged with other LLPs.

How to change a partnership into a limited liability partnership (LLP) in India

Can a partnership be changed into an LLP? Yes, you can. But before you can turn a partnership into an LLP, you must meet the following rules:

1. All the partners should agree on the decision to switch from a partnership to an LLP.

2. You must pay off all the debts that you have as a partnership firm.

3. If you've gotten any business certification under the name of the partnership firm, you need to get permission from the organization that gave you the certification.

4. Consent from the suppliers of the partnership firm is also needed.

Documents needed to change a partnership firm into an LLP in India

Draft documents for converting a firm into an LLP

1. Designated Partner Identification Number (DPIN): Filing an application under the DPIN must be done by all partners.

2. Digital Signature Certificate (DSC): This is needed to apply for digital authentication of the company.

3. Form LLP-1: This e-form must be filled out to add "LLP" to the existing firm name. So, the registrar will check to see if the name is similar to any trademarks or business names that are already registered or in the process of being registered.

4. A draft of an LLP agreement

5. File Form 17 with the Registrar of Companies (ROC): This is a conversion application form that must be filled out with the following attachments:

A. Statement of Consent of Partners for Conversion

B. A list of all creditors along with their permission to convert.

C. Statement of assets and liabilities of the company, signed by a CA

D. Approval from any other body or authority may be needed. Approval by the governing council for professional firms

E. Letter from the Income Tax Authorities

F. Financial statements for the Partnership Company

G. Details of any court proceedings

H. Rejection letter from ROC in case of any earlier conversion application

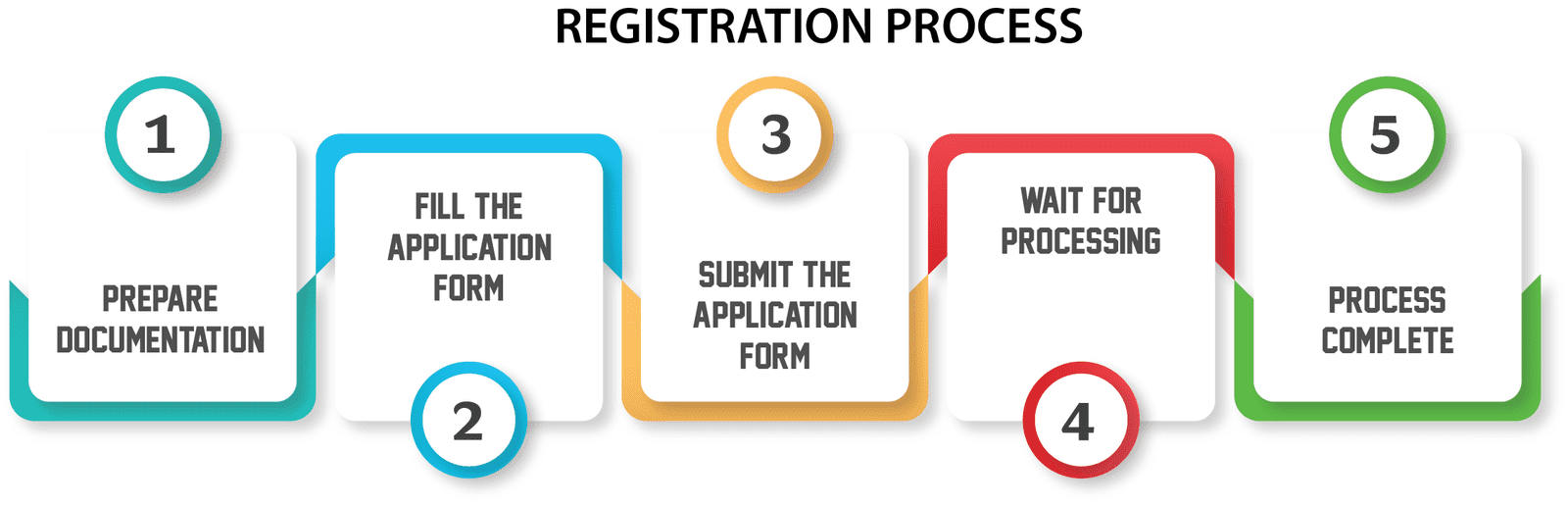

How to change a partnership firm in India into an LLP

How to change a partnership firm into a limited liability partnership (LLP)

Can a partnership become an LLP? Yes. And here's how a partnership firm can become a limited liability partnership:

1. Name: First, you have to get permission to use the name of the partnership firm for the LLP.

2. Get DSCs: After getting permission, you must get the digital signatures of the designated partners.

3. Apply for conversion: Fill out a FORM-17 with the Registrar of Companies. It's called "application of conversion."

4. Get permission: Get permission from your partners, suppliers, investors, and anyone you've ever owed money to.

5. Make a statement of all the assets and liabilities.

6. Apply to Incorporate: Fill out the online form for LLP incorporation.

7. Granting the certificate: Get the LLP's Certificate of Incorporation.

8. LLP Agreement: Make an LLP agreement using the points in the partnership deed.

9. ROF intimation: Tell the Registrar of Firms about the change from a partnership to a limited liability partnership (LLP) within 15 days.

Our Help in Changing Your Partnership to an LLP in India

We at Certpedia can help turn a partnership into an LLP from start to finish. Our services include:

1. DIN, DSC, and Name Approval

2. Filling out the form

3. Looking over the application and making any needed changes

4. Get the company's certificate of incorporation.

5. Writing up the LLP contract

Certpedia is a top legal consulting firm that offers a full range of services for changing a partnership firm to an LLP. We do the work required to add limited liability to your standard partnership firm.

So reach out to us and take the first step toward this change.