Private Limited Company to Public Limited Company

A privately held company is called an LTD, which stands for "private limited company." This means that the business owner's liability is limited to the value of their shares, and there can only be 50 shareholders. It also makes it hard for shareholders to sell their shares in public.

A company that is owned by the public is called a "public limited company," or PLC for short. It is a limited company with shares that can be bought and sold by anyone. PLCs can be listed on stock exchanges or not. To be a PLC, there must be at least three directors.

Public Limited Company Benefits

1. There are no rules about who can buy or sell shares because it is open to the public.

2. A PLC can help a lot of people, while a private limited company can only help a few.

3. PLC can get money from the general public, which gives it more chances to grow and do well.

4. Having a set way of doing things will help the business grow and the team work better.

Different ways to go public

A private limited company can become a public limited company for many reasons. But do these business leaders know that there are ways to change a private limited company into a public limited company? Converting a private limited company to a public limited company can be done for many reasons, such as getting more money into the business, letting anyone buy or sell shares, and so on. But the real task is to figure out the method and steps for conversion. So far, we've talked about the three most common ways for a private limited company to become a public limited company.

Issuing IPOs

Initial Public Offering (IPO)

The most common way for a private company to become a public company is through an IPO. But going public is a long process. After the change, the public company must follow a lot of strict rules. So, the company has to do a typical IPO during 6 to 12 months.

IPO process

In the first step of an IPO, the company starts to get ready for the move and does an assessment to see if there are any problems. To do this, the company hires an investment banker. This person figures out the company's goals, makes a plan, and gives you the report.

Next, the company starts putting the plan it made in the first step into action. During this time, companies gather the information they need to register and put together legal papers. Once the company files for registration, it stays quiet until the authority approves its plans to go public. During this time, when only limited information about IPOs can be released, the SEBI lets companies talk about other things, including giving out factual business information. Once the SEBI approves the company and it meets the requirements of stock exchanges, its shares can begin trading.

Now that the IPO is over, the company is officially open to the public.

Direct Listing: Skip the old way of doing things.

Direct listing is a fairly new way for companies to go public and raise money without doing an initial public offering (IPO). When a company goes public through a direct listing, it doesn't have to go through the traditional underwriting process.

Compared to the IPO

In the case of an IPO, the price of the shares to be sold is determined by the investment bankers. Most of the time, larger investors get more shares on the day of the direct listing than smaller investors. On that day, any investor will be able to buy and sell the company's shares on the stock exchange. Also, the buy and sell orders on the exchange figure out the price, so banks don't have to do that.

Direct listing has advantages.

This public sale of shares is good because it makes more people want to invest. Also, these investors can buy shares of the company, which helps make the playing field more level. In the past few years, companies like Spotify, Slack, and Coinbase have chosen to go public through direct listings.

About direct listings from SEBI

Not everyone agreed with the SEBI's recent decision to let direct listings happen. Two commissioners put out a statement saying that they thought taking underwriters out of the IPO process would take away a layer of due diligence. This will help to look out for the best interests of investors. If you want to buy shares through a direct listing, you should be careful.

When two publicly traded companies merge, this is referred to as a reverse merger.

In a reverse merger, a private company goes public by merging with or being bought out by a company that is already public. In a reverse merger, the company that buys the other one is usually a "shell" company or a SPAC (SPAC).

Even though the mechanism has been around for a long time, it has only recently become more well-known. Some people in the market think it gives them more control over pricing and deal terms than a traditional IPO.

How a Reverse Merger Works

A SPAC is a business that goes public without actually doing business or selling anything. Instead, the company does an initial public offering (IPO) and then uses the money it gets from the IPO. Then, the business merges with or buys another private business. After the merger, the leadership of the private company takes over. Also, the business of the private company is still run by the new company. As an example, Draft Kings, a company that lets people bet on sports, merged with Diamond Eagle Acquisition Corp., a public SPAC. In April 2020, after the merger, the shares started trading on the Nasdaq Stock Market.

Why would you pick a reserve merger?

A reverse merger is often a faster and less expensive way to go public. This is because the private company can merge with an existing company instead of starting from scratch with an IPO.

Criteria for making a private limited company into a public limited company in India

Before you can change your private limited company into a public limited company, you must meet the following requirements:

1. There should be at least seven people in the group.

2. You need at least three board members.

3. As an applicant, you must have at least 5 lakh rupees in your account.

4. Before you can do this private-to-public conversion, you need the approval of the board members and the financial and operational creditors.

Documents needed to change a private limited company in India into a public limited company

E-form MGT-14, "Special Resolution for Conversion of the Company into a Public Company," must be filed with the following attachments:

1. Changes to the Memorandum of Association and Articles of Association

2. An official copy of the Board's decision to change (optional).

3. Notice of an extraordinary general meeting (EGM) that will be held to pass the board resolution, which is the directors' approval for changing a private limited company into a public limited company.

4. From INC 27: Request to change a private limited company into a public limited company

5. The minutes of the meeting where the change and new articles of association were approved

How to change from a private company to a public company in India

How a private limited company becomes a public limited company

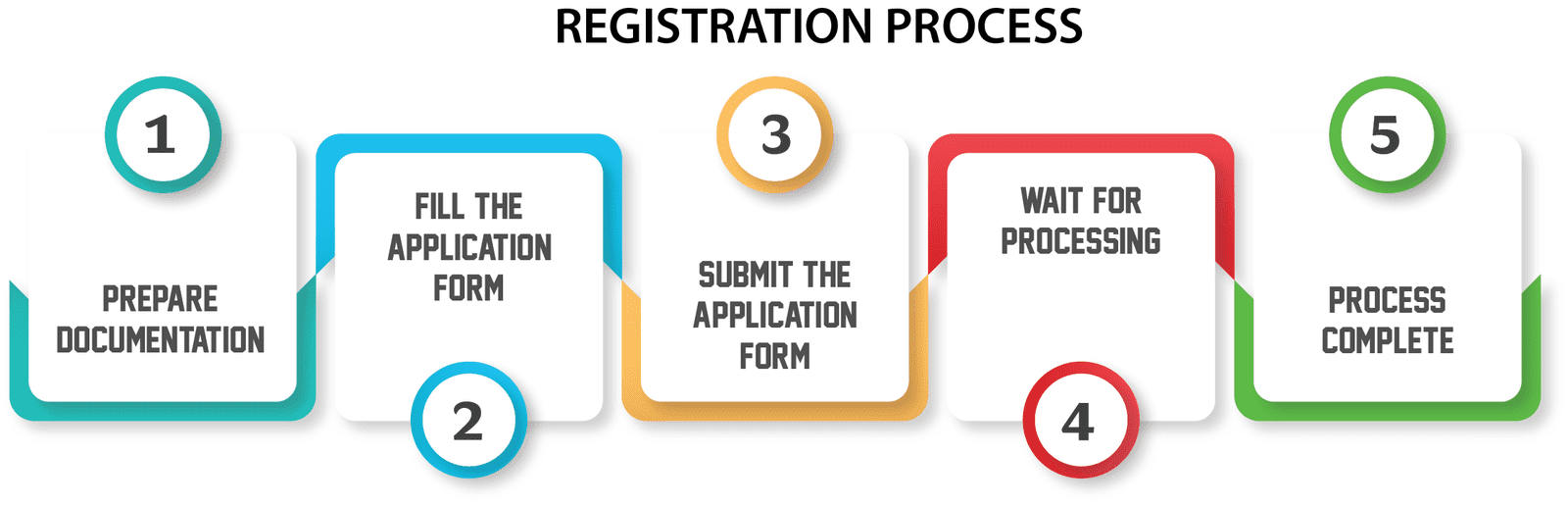

How do I make a private company open to the public? The steps to change a private limited company into a public limited company are:

1. Call a board meeting and, once everyone agrees, pass a resolution to convert your private Ltd company to a public Ltd company (LTD to PLC).

2. Invite all of your shareholders to an extraordinary general meeting. Pass a special resolution that says they agree to the change as described above.

3. Vote for the resolution to go from two to three board members (if applicable).

4. File with the ROC to change the articles of association.

5. Turn the private limited company into a public limited company by filing Form INR 27.

6. When you file the application, include INR 27 and a copy of the Certificate of Incorporation for your private limited company. It will tell the registrar to start the process of changing the name.

We'll help you turn your private limited company into a public limited company in India.

At Certpedia, we can help you change from a private limited company to a public limited company. Our services include:

1. Making changes to the company's Articles of Association

2. Fill out Form INR-47.

3. Looking over the application and making any necessary changes.

4. Getting the form to the Registrar of Companies

5. Getting the public limited company's Certificate of Incorporation

Standard Solutions is a top legal consulting firm that offers a full range of services for changing a private limited company into a public limited company.

So reach out to us and take the first step toward this change.