In India, convert a sole proprietorship into a private limited company.

One person owns a proprietorship company, also called a sole proprietorship company. Here, the business owner and the business have the same legal status. The owner has direct control over all aspects of the business, is responsible for how it runs, and keeps all of its profits or losses.

A private limited company, often abbreviated as "LTD," is a privately held company. In a private limited company, the owners' liability is limited to the value of their shares, and there can only be 50 shareholders. It also stops shareholders from trading shares openly.

Advantages of changing to a private limited company

Limiting liability to shares

Financial risks are a normal part of doing business, but they must be kept to a minimum if the business is to keep growing. For example, if an LLC were to close for any reason, the shareholders wouldn't risk losing their personal assets.

No takeover risks

When two shareholders trade shares, the risk of a takeover is lessened because selling and buying shares is only possible if both parties agree.

Perpetual Existence

Private companies with limited liability are "incorporated." So, it still exists even after the owner dies.

Raising Capital

In a sole proprietorship, only one person has access to the business's capital or investment options. With a limited liability company, this is not the case.

Tax Exemptions

Profits from private limited companies are taxed. But shareholders don't pay taxes on dividends. Instead, taxes are based on the person's income tax rate.

Large Enterprise

It is easier to meet the standards of a large business than a sole proprietorship. But private limited companies can attract talented workers who help the company grow a lot.

Manageability

In a sole proprietorship, one person is responsible for all of the business's operations and management. In contrast, LTD makes it much easier to run a business.

Criteria for changing a sole proprietorship to a private limited company in India

Before you change your business from a sole proprietorship to a private limited company, you must meet the following requirements:

1. No one person can be in charge of a private limited company. So, you would have to choose another director.

2. You need at least two investors.

3. You should get permission from everyone you owed money to when you were a sole proprietor.

4. You must have the most recent financial records for your sole proprietorship.

Documents needed to change a sole proprietorship in India into a private limited company

How do I turn a one-person business into a Pvt. Ltd. company?

When you file an application to change from a sole proprietorship to a private limited company, you must include the following documents:

1. The sole proprietorship and private limited company must make a written agreement and send it to the Registrar of Companies.

2. All directors' Digital Signature Certificates (DSC)

3. All directors' Director Identification Numbers (DINs).

4. The Memorandum and Articles of Association (MOA and AOA) were changed.

5. Form 32: This form needs to be filed whenever there is a change or update to the board of directors.

6. Form 18: This document tells where the proposed company's registered office will be.

7. Form 1: This form needs to be filed to make sure the name of the newly formed company is available.

8. Authorization letter or power of attorney (POA)

In India, the procedure for converting from a sole proprietorship to a private limited company is described.

Procedures for changing a sole proprietorship into a private limited company

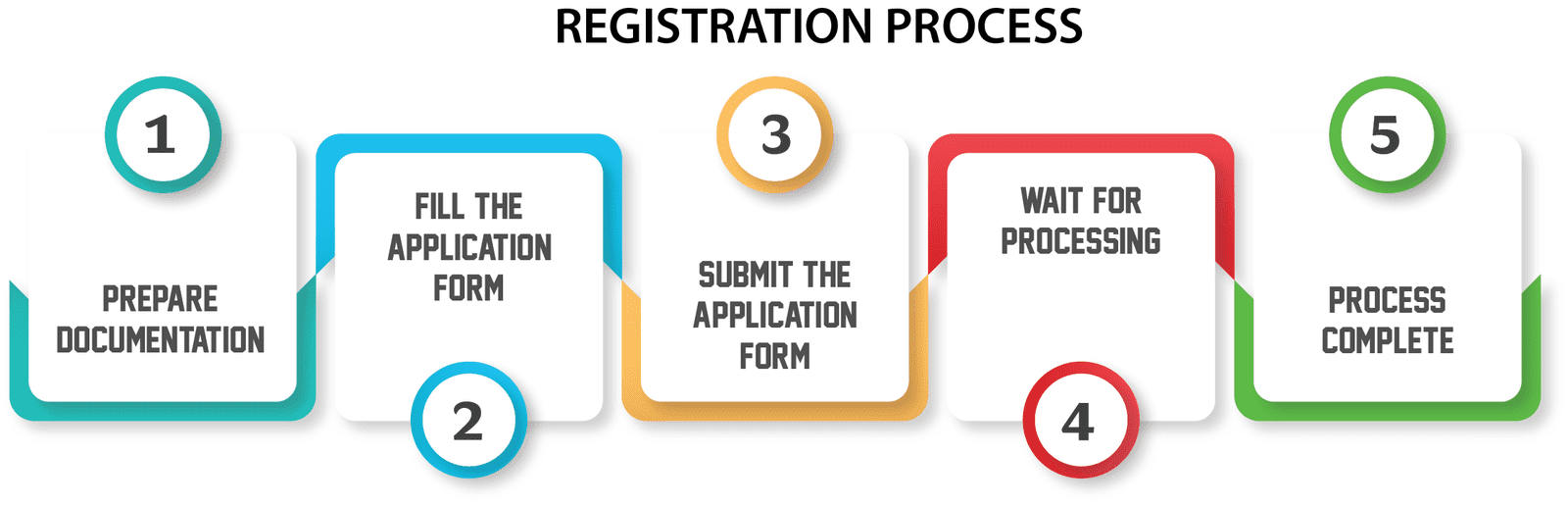

Here's what you need to do to change a sole proprietorship into a Pvt. Ltd. company:

1. Take care of the paperwork for your slump sale as a sole proprietor.

2. Choose someone else to be the head of your new private limited company.

3. Give the said director and yourself a DIN and DSC.

4. Use the RUN form to file an application to reserve the name of your limited company.

5. Create a memorandum of association outlining the purpose of your company and articles of incorporation outlining how your company will operate.

6. Submit the application to form a company.

7. Get the company's Certificate of Incorporation.

8. Get the PAN and TAN numbers for your newly created private limited company.

9. Change your bank information to reflect your new business entity.

We'll help you change from being a sole proprietor to a private limited company.

We at Certpedia can help you switch from a sole proprietorship to a private limited company from start to finish. Our services include:

1. DIN, DSC, and Name Approval

2. Submitting the Form

3. Looking over the application and making changes if necessary.

4. Get the company's Certificate of Incorporation.

5. Helping you obtain your PAN and TAN,

6. More help with keeping your books in order.

Standard Solutions is a top legal consulting company that offers a full range of services for changing from a sole proprietorship to a private limited company.

So, take the first step toward this change by getting in touch with us.